Last night, Samsung reported its full results for the second quarter. As it usually does, it had signaled roughly what results would look like at a high level meeting a couple of weeks earlier, but we now have the full details. The results in the earnings report present a nice summary of the challenges Samsung faces at this point in its history.

First, the good news

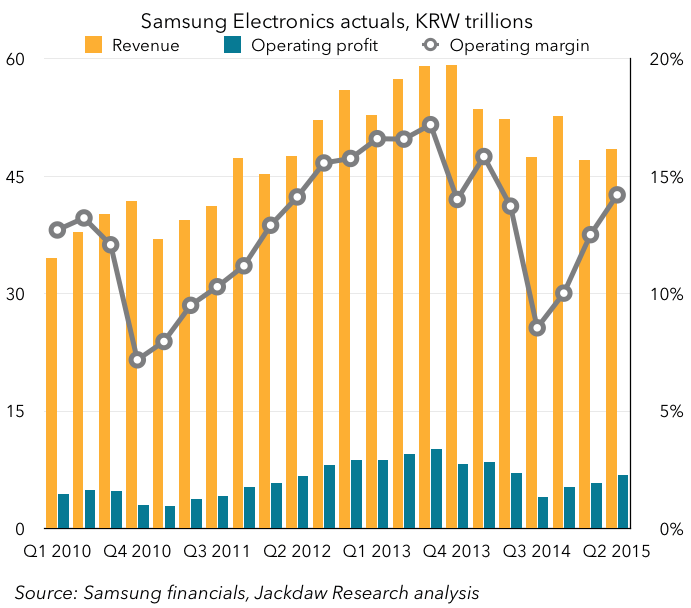

The good news is it’s becoming clearer that Q3 last year was the nadir of Samsung’s crisis, and that things have actually improved quite a bit since then, as shown in the chart below:

As you can see, Q3 was the low point for margins, operating profits, and possibly for year-on-year revenue declines too. All three metrics seem to have recovered a little from then, although we’ll have to see this year’s Q3 before we can be certain. What is clear is profits and margins have recovered significantly for Samsung as a whole, while revenues are now back to 2012 levels, though still down from their peak in 2013.

Semiconductors, not mobile, the star

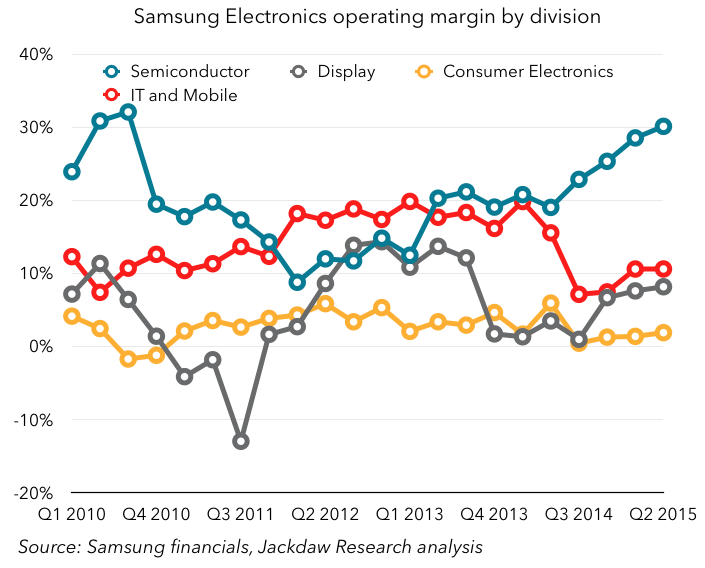

However, whereas Samsung’s peak was driven by its mobile devices business, the current star is not mobile but semiconductors:

Semiconductor margins were eclipsed by mobile margins for a period in late 2012 but, since then, they’ve been increasingly moving ahead as that business finds greater and greater success even as the mobile business flounders. Despite the fact the semiconductor business is quite a bit smaller than Samsung’s mobile business unit, it generates higher total profits thanks to these higher margins.

Mobile hasn’t recovered as well

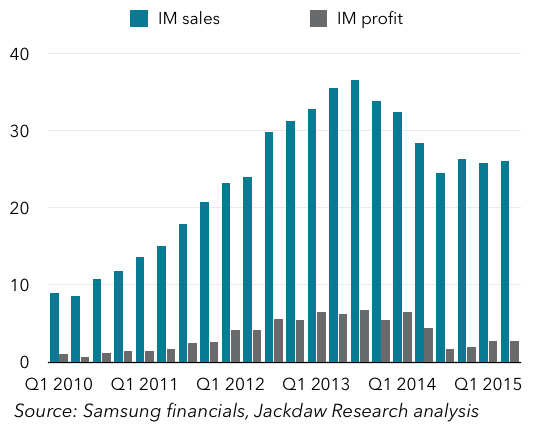

Although Samsung’s overall business has recovered somewhat from its downturn, the mobile business remains mired in stagnation rather than returning to growth. The IM (IT and Mobile) business unit, dominated by mobile device sales, is enjoying a new, much lower normal, rather than a resurgence to anything like its peak:

Both revenues and profits are significantly down from the heady days of 2013 and there’s no sign things are going to recover. Though the decline has stopped, at least for now, it’s come, at least in part, at the cost of significant price reductions and Samsung has now signaled it will begin discounting the Galaxy S6 to try to spur lackluster sales, a very early concession they are falling short of expectations.

A pincer movement is to blame

What’s the reason for this struggle to grow? Well, that’s been well covered before and it comes down to what is effectively a pincer movement, with Apple at the high end and a variety of Android vendors, most of them Chinese, at the low end, pressuring the two parts of Samsung’s mobile business at the same time. Samsung has lost scale at the low end, which directly impacts margins and the inroads into its premium business by Apple and the resulting slashed prices have cut into margins at the high end. Even if Samsung manages to stabilize shipments and revenues (and there’s no guarantee it can), it’ll likely do so at far lower margins.

Where does Samsung go from here? Well, stabilizing the mobile business as best it can is clearly a major imperative, but Samsung’s future has to look beyond that too. The semiconductor business is one strong possibility – between them, these two divisions account for the vast majority of Samsung’s profits today. So, if mobile isn’t carrying its weight, the semiconductor business must step up. Samsung has, ironically, benefited in this part of its business from Apple’s competitive success in smartphones but it’s not yet clear Samsung can win many other component contracts from competitors, let alone those that are growing the fastest. However, there are opportunities in the new markets where chips are finding their way into devices and even relatively dumb objects in what is invariably referred to as the Internet of Things. In reality, that’s a diverse set of opportunities, but Samsung has already demonstrated its intention to compete in wearables and home automation at both the device and chipset level, so there may be some growth opportunities there. However, what’s becoming increasingly clear is Samsung’s future is quite a bit dimmer than its past.

I’m wondering how Samsung’s phones moving-target sets of flaws impact their short and long-term prospects. Both the flaws and their inconsistencies make one’s head spin: only last year Samsung’s flagship was a plastic all-dayer mocking wall huggers, this year’s is a metallic jewel that won’t last a semi-intensive day.

Not being able to make a flawless phone is an issue in itself, but wheel-of-disfortuning yearly between the gamut of possible flaws seems far worse, and requires a lot of mental gymnastics to keep loving the brand?

I don’t know Samsung overall very well (I love our washer and dryer), but it seems they aren’t able to key in on mobile any more. They really did seem to dig in on a counter Apple image. But NOT being someone can only get you so far. Then they decided to be more like iPhone and ditched some of the features Samsung owners loved. I’m not at all convinced they had any idea who their customers actually were and why they liked/loved their Samsung phones. That’s unfortunate. Sometimes the smarter move is to figure out what brand you have instead of constantly fiddling with the brand you want.

Joe

That’s the thing, Samsung themselves don’t know why people bought them in the first place, because they never had a cohesive strategy. They had a throw it all against the wall approach and it worked amazingly well for them, between 2012 and 2013. When things started to go south, they could not pinpoint the reason why. We now know it’s a combination of the Chinese oem’s rise with great products at half the price and Apple finally decided to compete head to head that’s putting a lot of pressure on them.

The problem Samsung is having now is that, they have put so much importance into market share, that they will have to forego a lot of their margins if they plan on maintaining that strategy. You can always increase your market shares at the expense of profits. Apple to this day have chosen not to pursue that strategy, and they were right. Because I remember well during those 2012/2013 how everyone, every critic’s wanted them to build a cheap iPhone. And I remember how the 5C was received by the no clue analysts.

Apple was able to do what they did because selling the most at the expense of their brand and profits have never been their strategy. They did so for years with the mac, the ipod was just an exception.

In my recollection, actually, the iPod illustrates what Jobs has always said, i.e. that if they could make something to their standards of quality that was also cheaper (as in less expensive) they would. So iPod shows they don’t mind going cheaper if they feel they can keep to their standards of quality.

Joe

I believe the technical term is “balls on accurate”! (Lisa Vito-My Cousin Vinny)

Edit: But….In android, you have choices…. So Samsung dies. Who cares?

Most of us here don’t care, but I suppose someone should…

This discussion has already covered how Samsung, as a company, is best placed to be an Android OEM that can actually deliver high-end premium handsets. If not, Samsung then who? Samsung does components, design, marketing and distribution.

What are these actual “choices” as alternates to a Samsung Galaxy (the latest model of which is not doing great)? Maybe 1 or 2 sony’s, LG’s, or HTC’s?

I guess the thinking would be: if Samsung’s struggle to stay in the premium Android handset business at any scale is any indicator, then that doesn’t bode well for future innovation and delivery from anyone else. If Samsung bows out, as a company that actually makes some money, then why would others not also how out when they are struggling to make any money in the same space with less resources and advantages.

What “choice” does that leave the consumer for Galaxy comparable devices? That is why one should care — because all that Android “choice” isn’t what it is cracked up to be.

Samsung is not a Premium experience company. Never has been and never will be. They are a all of market company, the target the whole market with their scale and flood it and see what sticks. Premium companies are very targeted. Google is not interested in a premium experience on Android, they want a race to the bottom in order to make Android accessible to everyone so they can have a huge supply of data. A premium experience, is a limited access experience and that is not in Google’s interest . Android OEM’s are screwed

So you don’t care that the only company making profit from Android (besides Google) dies?

How many choices will you have if no or few android device makers can make enough profit to invest in future products?

No. I’m on the opposite end of the negotiation. As long as enough people don’t want an iPhone (as currently implemented), there will always be someone else. If you’re right, Apple will have dominant market share, and be forced to open up. Even if that doesn’t work, I’ll get a non smartphone and use a laptop.

Apple historically only cares about the very high end of the market. They target a market, assault it and vacuum out the profits and let their enemies cut themselves to pieces fighting for the scraps Apple leave behind. Giving Apple time and money to launch yet another assault on another market. So they will never have majority of the total market share,just the majority of the most profitable end of the market

Yes, but as I said, their fortunes are not my interest. My interests are paramount, to me.

Nice analysis. While they have a solid semiconductor business, being beholden to Apple for a fair chunk of volume and profits cannot be a comfortable position. Apple has a history of punishing rivals (when it makes business sense) and given its attempts to bolster TMSC (and ability to prepay for a fab or 3) this is a major risk for Samsung.

The Intel/micron memory breakthrough may be another issue for the DRAM business.

What I think is remarkable about how Samsung is handling this situation is that they have managed to stabilise at only 30% lower than peak sales, and are still managing to make a profit in the handset business. This is very different from Nokia and Blackberry which plummeted with no end in sight. Obviously, then have managed to quickly cut back on costs and adjust their business to the unfavourable market environments. It’s only a single year since their peak, and their nimbleness is amazing. It really shows how quick Samsung is to adapt to change and how formidable a competitor they are.

Looking forward, I see Samsung taking the long-term approach to the next phase of innovation. They have remarkably managed to make the Tizen Z1 into India’s best-selling smartphone. Also, although I don’t know the exact numbers, I think Tizen-based smartwatches are selling at least as well as all Android Wear devices combined, although there is a report that Tizen smartwatch market share is crumbling. Samsung seems to have learnt its lesson and is moving forward for the long-term, not the short-term.

Although the prospects fro Samsung’s mobile business continue to look rather dim, it’s still a company that deserves a lot of respect and fear. It’s not crumbling inside, and I see it doing the best that it, or anybody else for that matter, can in a very challenging environment.

http://www.counterpointresearch.com/indiahandsetmarket2q2015

http://iphone.appleinsider.com/articles/15/06/28/after-crushing-rival-smartwatch-sales-apple-watch-portrayed-as-doomed-by-cnbc

http://www.sammobile.com/2015/06/15/tizens-smartwatch-market-share-falls-to-less-than-half-during-q1-2015/

You may be right. But I am of the opinion it is pure luck. At best it is simply strategies that work in the appliance industry and have some coincidental application in IM. Then again, I have no idea what IT is to Samsung and how much that may be propping up mobile in the charts.

Joe

To determine whether we can dismiss Samsung as just a company with simple appliance industry strategies, the benchmark would be to compare Samsung to the former innovators in IT and telecommunications. Samsung has fared much much better than those companies.

I would agree with you if Samsung had a history for applying their innovation strategies in the handset division. Mostly they have been applying their appliance strategies in handsets—Blackberry rip offs Motoroloa Razr rip offs, etc, just like the whole appliance and TV industry is about everyone’s products essentially being the same, with minor exceptions like someone’s red being redder than everyone else’s. And of course, that strategy works well enough until someone does it better than you, such as Xiaomi on the low end and Apple on the high end.

IIRC, the mobile division does have new leadership, which could equate to your conclusion, but I’ll have to see more to believe that is the case. As it is, if they _don’t_ change, I have a hard time believing they’ll maintain the leveling you admire. And as I said, it still isn’t clear from the data if mobile is being propped up and things may be worse than you perceive.

Joe

I’m not sure I follow. The companies with a history of innovation in handsets, Motorola, Nokia, and Blackberry have done much worse than Samsung, to put it mildly. Why do you think a history of innovation is important?

Sorry. I miss understood. I thought you were talking historic Samsung innovation strategies somehow having a positive affect on Samsung’s potential future. Otherwise, I was just riffin’ on your comment about innovation.

However, I still don’t see Samsung doing anything to make me believe they aren’t simply copying their appliance industry strategies to their mobile and handset divisions. I do believe most of the mobile industry suffered more from Samsung than from Apple.

The appliance industry is more comparable to low-end Android than Apple, which is why no Android handset maker has really had the know how to compete with Samsung until Xiaomi and other low-end devices out-applianced Samsung.

On the premium end, you have to know why customers will want your products beyond the appliance. Samsung has no experience there which is why, once Samsung’s major innovation (larger screens) were swiped and they ditched the few other things that differentiated them from iPhone (SD and removable battery), there was nothing left for them to hang onto.

So I don’t see them being able to hang onto much unless they figure more things out.

Joe

Yes, I agree. We need a better understanding of how they managed to level out despite being absolutely slaughtered in China and significantly hurt by Apple’s iPhone 6/6plus. It seems they were maintaining their market position in India, for example, which is impressive given the rise of local vendors. Their margins have obviously been impacted, but they still command the vast majority of profits in the Android ecosystem.

At this point, neither Samsung nor anyone else is competing with iPhone any more. The race is to survive in the cutthroat Android ecosystem, and to somehow escape from the race to the bottom. This is what Xiaomi is doing with their services, and what I think Samsung hopes to achieve with

Tizen.

I think Samsung should now be evaluated based on its position relative to other Android OEMs, and no longer in comparison with Apple. In this regard, Samsung is holding its position much better than the other giants that collapsed.

“Samsung is holding its position much better than the other giants that collapsed”

The only problem with the charts, though, is how much mobile is obfuscated (or not) by being combined with “IT”.

Joe

That, I totally agree with. We need to look at it in more detail and combine it with the shipment statistics that are provided by independent analysts for example. Although this will give us an idea of their top-line, it will probably be more difficult to see what the profits are like.

“At this point, neither Samsung nor anyone else is competing with iPhone any more.”

Well said, and very true. It is also interesting that both Samsung and Google have become dependent on Apple (mainly due to the iPhone) for a reasonable chunk of profits. Samsung as a supplier and Google via user engagement.

Well, since we’re speaking competitively…Samsung can afford to close it’s mobile division. Can Apple?

Why would Samsung, or any other company for that matter, close a profitable division that still leads the global market in units shipped? Why would Apple close the division that generates the bulk of its profits, profits that equate to the sum of that of many Fortune 500 companies?

I’m sorry, I don’t understand your point.

The article, logically, brings up Apple as well.

I was simply pointing out that Samsung can afford to exit handsets (in the extreme) and that their main competitor, Apple, can’t.

Apple could actually, they would just be a smaller company after they shut down their iPhone business. How about adding value to the discussion in the future? Your last two comments have been cheap shots at Apple. We get it, you don’t like Apple. Time to cut the jokes and actually discuss something.

I’ve been following the oldest rules of syntax, ‘what is easily understood, should be omitted’. The article clearly indicated just how well diversified a company Samsung is, and then went on to contrast it with Apple. I’m not an investor, and I rarely participate in these discussions, but if I were, I would be looking towards companies like Samsung more than a company that depends so much on it’s primary product. Worse, unless Apple starts building, or financing fabs, they need Samsung more. What percentage of an iPhone’s componentry involves a Samsung to Apple sale?

OK! I got your point. So you are saying that by being diversified, investors tend to see less risk in Samsung and hence value it more. That would be one plausible explanation of why Apple’s stock is seemingly undervalued, and I think some other respected people provide similar theories.

Personally, seeing the mess that many Japanese electric/electronic companies have gotten themselves into, I tend to not see value in diversification, and I am of the opinion that it can actually be toxic to a company. Having said that, Samsung is very strong in many areas so for them it seems to be working out well. Furthermore, I’m pretty uninterested in understanding how investors create their own models; I’m more interested in understanding how the real world works.

To add some more perspective, whether or not a company can “afford to close its division X” is probably not driven by the financial situation and how much weight that product has. I think its driven by the culture of the company, and whether it has a value system or mission that goes beyond the product. In the case of Apple, the question is whether the value system of Apple is driven by personal computers or mobile devices, whether it is driven by design, or whether it is driven by the desire to sit at the intersection of technology and the liberal arts. If it is the last, then I believe Apple will have no trouble jettisoning the iPhone if sales should falter in the future.

Take a look at Nokia for example. Nokia is a company. Founded as a pulp mill back in 1865, it incorporated rubber, electricity telegraph and many more products before entering telecommunications in the 1970s. In my opinion, that diverse history and a value system that is not associated with any single product or market is what allowed Nokia to jettison the handset business. Nokia seems to be doing OK thereafter, growing its remaining businesses.

https://en.wikipedia.org/wiki/History_of_Nokia

So in summary, although I agree with your statement that Samsung is more diversified and investors may consider it to be more stable, when it comes to the decision of whether a company is willing to get out of a business or not, the weight of that business in that company’s financials is probably not the main factor in the case of companies with a strong culture. In the case of Apple, I would not be surprised if it got out of the smartphone business or even the general purpose computing devices market in the coming decades.

You’re ever the gentleman, I should probably emulate you more. But then I wouldn’t be me…. 🙂

Like I said, I’m not an investor. There’s several reasons for that. First of all I don’t derive pleasure from it, it’s not fun to me. Secondly, I more often than not cannot make sense of it, so it can’t be work either.

But as I understand it, a company’s stock price is not so much related to how it’s currently performing (an initial condition), but rather it’s a bet on how it will perform in the future. There’s that gambling thing again…Growth in China, which even I know is going to go through the roof, may already be accounted for in the stock price today. Wall Street rewards and punishes ‘change’ more than anything else.

So yes, I intentionally brought up an extreme example (extremes often bring out the flaws in a model) about Samsung getting out. As you say, they would get out if they felt they weren’t being paid enough for their efforts, and I agree it would be short sighted of them.

Turning to Apple.. It’s a limited product assortment, with essentially one product carrying the day. It’s also very fashion sensitive, and fashion is fickle. This brings risk, which brings reward. Reward without risk is a ‘bubble waiting to happen’,

Yes, I think we’re in total agreement on investors, and I agree that investors might value Samsung more than a risky business like Apple.

Regarding Samsung and its possible exit from the handset business, I do think it is a possibility. I like to look at the state of Japanese electric/electronic companies to read the (green) tea leaves. Companies like Hitachi have managed a turn around by getting out of digital consumer electronics and focusing on industrial electrics and analog consumer appliances. I hear that Panasonic is doing the same. Sony is also having a good run in providing components instead of selling consumer devices. My sense is that whereas consumer products commoditise easily, components and industrial equipment take much longer. With industrial equipment, companies can attach a hard price on the financial impact of higher quality and hence quality tends to be valued higher (this is not the case though in IT, where the value is in the software, not the hardware). I think this is why Japanese companies are finding better fortunes there. I expect as the Chinese commoditise smartphones, Samsung will also have not choice but to do the same eventually.

Not directly related to the current topic, but a thought that I wanted to get out of my head….

If Samsung stays a supplier, however, it does not have to completely exit handsets. It could keep a few products out there, ala Google and Nexus as sort of ongoing research. I wonder if Google has any hardware analytics in the OS to determine which hardware features are most used?

Joe

I think that to answer that question, we have to understand the cost of the whole smartphone operations for Samsung. In the case of Google Nexus devices, Google did very little. They did not do production at all. Nor did they do much marketing or channel management. I’m not even sure that they did much hardware design. This is probably why the Nexus devices sold very little and why inventory management was a disaster (I imagine the Amazon Fire tablets were similar). Hence for Google, there was very little fixed cost associated with the Nexus line. In the case of Samsung, this would be very different. They have a very large marketing team with a large budget and I’m sure they’re very good at channel management. They also probably have huge hardware design teams. It isn’t economical for Samsung to just create a few products unless they totally restructure their operations.

Although I wouldn’t totally dismiss the possibility, I think that Samsung can’t simply reduce their product line. They are structured very differently from Google, and the economics associated with having a few handsets would be very different from Google selling a few Nexus devices.

There are some investors (I’m one of them) who believe diversification dilutes potential earnings.

Joe

I understand. Diversification mitigates risk, which by necessity should mitigate reward. No?

It’s up to everyone’s temperament.

You make the mistake most Analysts make. Apple is not dependant on the iPhone. The iPhone on its own is a bigger business than Samsung. If you add the iPhone to Samsung or any company in the World, the iPhone would be the overwhelming majority of that company. The rest of Apples business is massively profitable. They are only dependant on the iPhone for outlandishly obscene profits. If the iPhone goes, they will be a massively profitable company, as opposed to obscenely profitable

Definitely what a great blog and instructive posts I definitely will bookmark your site.All the Best!

Some really excellent info, Sword lily I detected this.

I’m in disposition with the https://organicbodyessentials.com/collections/organic-body-creams ! The serum gave my peel a youthful encouragement, and the lip balm kept my lips hydrated all day. Knowledgable I’m using clean, habitual products makes me tolerate great. These are now my must-haves in behalf of a inexperienced and nourished look!

I gave https://www.cornbreadhemp.com/products/full-spectrum-cbd-gummies a try for the treatment of the maiden previously, and I’m amazed! They tasted excessive and provided a sense of calmness and relaxation. My lay stress melted away, and I slept better too. These gummies are a game-changer since me, and I extremely endorse them to anyone seeking natural worry liberation and think twice sleep.

CBD, or cannabidiol, has been a engagement changer for me. D8 Gummy I’ve struggled with longing into years and press tried sundry different medications, but nothing has worked as well as CBD. It helps me to be undisturbed and relaxed without any side effects. I also find that it helps with take and labour management. I’ve tried several brands, but I’ve found that the ones that are lab tested and play a joke on a high-minded repute are the most effective. Comprehensive, I highly plug CBD representing anyone who struggles with worry, be in the arms of morpheus issues, or lasting pain.

I’m in young lady with the cbd products and https://organicbodyessentials.com/ ! The serum gave my shell a youthful help, and the lip balm kept my lips hydrated all day. Knowing I’m using disinfected, natural products makes me feel great. These are in the present climate my must-haves for a saucy and nourished look!

I’m in attraction with the cbd products and https://organicbodyessentials.com/products/cbd-balm ! The serum gave my epidermis a youthful support, and the lip balm kept my lips hydrated all day. Private I’m using moral, bona fide products makes me guess great. These are infrequently my must-haves for a unorthodox and nourished look!

Wow, marvelous blog layout! How long have you been running a blog for?

you made blogging look easy. The total look of your site is excellent,

let alone the content material! You can see similar here sklep internetowy