When it comes to the computing products I study — TVs, smartphones, tablets, PCs — I tend to talk primarily about what is happening in China and the US/Europe. Mostly because, for most consumer tech products, China and the US are the largest markets by population for consumer technology. While there is a great deal of competition and technological activity in the US and China, these markets are quickly becoming replacement markets for most tech products and not a green field. Because of this reality, growth rates in these regions for things like smartphones, tablets, and even PCs in many cases have slowed dramatically. India, however, is a completely different story.

India will be the world second largest market for smartphones. With a population of just over 1.2 billion, India has nearly as many people as China. Yet, unlike China, smartphone penetration is still extremely low in India. Consensus installed base estimates for smartphones in India are in the 110-120m. Total mobile subscriptions in the country is over 900 million. Over 70% of the population has a mobile subscription and roughly 10% of the population has a smartphone. With the vast majority of consumers in the country still using a feature phone, the upside growth for India is massive. Several years ago, many of us in the analyst community kept highlighting China as the growth opportunity. India is currently where China was a few years ago when our focus was on China. India represents the next big growth opportunity — yet it will also come with many challenges for global players looking to compete in the region.

As I’ve studied China, the US, and India, it becomes clear each of these populous regions are very different when it comes to consumer tech. Each country’s unique culture plays a role in how local consumers view technology and how it impacts their desire to purchase and use certain products and services. This is fundamentally why local hardware companies are gaining specific advantages over foreign ones due to their understanding of the local consumers needs.

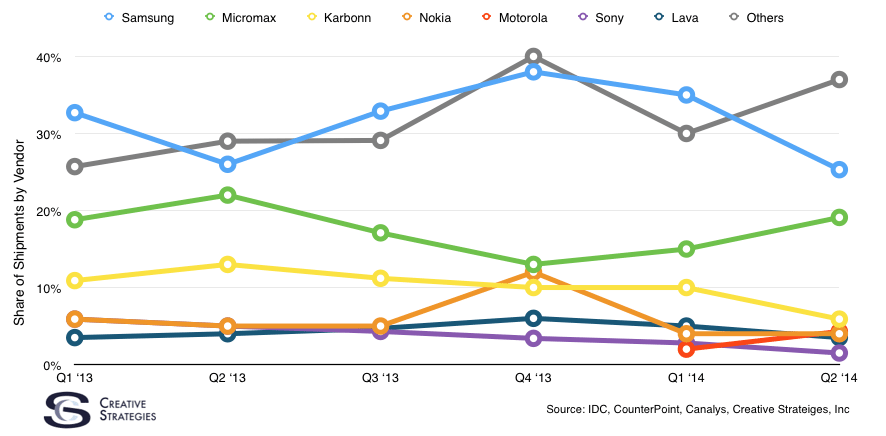

As I pointed out in this analysis of smartphone regionalization trends, India is still anyone’s game from a hardware standpoint.

The model predicts Micromax, a local India brand, is poised to overtake Samsung as the number one smartphone quarter by the end of 2014 and quite possibly has already done so by the end of Q3. Watching local brands rise to power in both China and now in India is truly fascinating.

While China is also a relatively price sensitive region, India may be even more so. Not entirely due to economics but largely because Indian consumers have what is called a “value for the money” mentality. They tend to not pay more for something when a lower priced product is more value for the money. This value conscious mentality is more prevalent en masse in India than many other regions we study. Parts of Europe such as Germany and Spain show similar value-centric mentalities but obviously the scale of India is much larger than Germany and Spain.

Indian consumers, like many consumers, don’t want cheap products. Their focus is on finding value. Good specs at a good price is the major theme. This will be a key metric as smartphone vendors look to convert the large user base of feature phones to smartphones. Android One will play a role in driving feature phone to smartphone conversion. Google is aggressively looking to gain a foothold in India and Android One has a key role in that strategy. Currently, Android One has a number of hardware restrictions in order to keep the price down. Over time I believe this will change as Google continues to keep Android One hardware both price and spec competitive.

What becomes clear, and is common in both India and China, is how hard it will be to make money on hardware in these regions. Instead, companies will have to look to monetize services more than hardware. As I look at where, and how, revenue opportunities are going to present themselves in this region, I am increasingly convinced it will not be in hardware.

Companies looking to compete in India will have to take a services driven approach. This is why Google could be well positioned but also perhaps Xiaomi. What is interesting to me about Xiaomi’s model, which I outline in this video analysis, is how so many of the ways they make money are similar to Google. Xiaomi makes quite a bit of money from app stores and content stores for books and games. I have a hard time believing they will give up these revenue drivers and give that revenue to Google instead as they look to enter India. Given the green field that is India, Xiaomi’s services model, which is many ways competes directly with Google, has as good of a chance as any to gain a foothold.

Apple in India will also be challenged. There are likely only around 10-12m iPhones in use in India based on my estimate model. Older generation iPhones seem to be perceived as higher value for the money than current generation iPhones and appear to move in more volume than current generation iPhones. While Apple may not find great success with current generation products in India, it seems their later generation products could be their angle to grow in the region.

Outside of Xiaomi and Apple, Motorola is the other foreign brand that I’m keeping an eye on. Motorola has been catering strongly to the value for the money mentality and seeing steady growth in sales from India.

Ultimately, this is exciting for both the country and the technology industry. As we saw with China, as pocket computers gain in popularity, a tech boom emerges. I believe we will see perhaps even more interesting innovation, particularly in software and services, come from India.

So what is beyond India? I get asked quite a bit about what other markets have my interest. Right now it is Brazil and Indonesia. Each very different as well from all other regions I study and equally fascinating from a consumer tech standpoint. I’ll likely do a highlight on these countries as well in the future.

Good Analysis

I do think that India is the perfect country for Android OEM’s primarily Motorola,

Xiaomi, and One+One and Google but a nightmare for company like Samsung and Apple.

while in the other end i also believe that the Chinese market is extremely more fragile for a foreign brand such as Apple because of political issue and nationalism

No mention at all of per capita incomes? Such as when you say that the Indian consumer is more ‘price sensitive’ than China, no reference at all to the fact that China’s per capita GDP is about 4.7X that of India’s.

Let’s look at comparative numbers (source: IMF) for per capita GDP. USA-$53,000, China-$7,000, India-1,500. These are significantly different numbers and anytime one does a comparative study of consumption patterns in the three countries, you have to bring per capita GDP into the mix and not just say “Each country’s unique culture plays a role in how local consumers view technology and how it impacts their desire to purchase and use certain products and services.” I’d say incomes are at least as important as culture.

I could spend an entire post on the economics side but that wasn’t the goal of a big picture view of India. Despite that, I don’t disagree with you, but what looking at those numbers makes everyone assume is that due to those economics low-priced phones are all they want. This is simply not true, a VFM mentality is only partially driven by the inability to afford excess. Rather culturally you are looked upon favorably for making a decision. India, like China is a spec driven market, however, Indian consumers are more pragmatic where Chinese consumers are more emotional in there purchases.

I could spend an entire other post on the behavioral economics differences of these two regions as well. The value a smart phone brings is disproportionate to income levels or the wealth of a nation. Especially when it can help you run your business, provide for you family, etc.

I see the point in everything you say and I’m not saying personal incomes explains everything, but still, I think you’ve got to at least mention it, even just a sentence, to give readers a glimpse of the whole picture.

Otherwise, people who are unaware of the difference in incomes will think all three markets are roughly equivalent and should be of equal importance to smart phone manufacturers. Well, no. Even if India represents “the next big growth opportunity” because only 10% of the population has a smart phone, the absolute (as opposed to) percentage growth opportunity is tempered by the low personal incomes. It is not anything comparable to the growth opportunity offered by the US market when only 10% of the US population had a smartphone.

I would bet that for people who are unaware of the disparity in personal income levels, they will think, perhaps subconsciously, that the heft of the Indian, Chinese and US markets are more or less the same. Or much closer than they really are.

Maybe it’s just me but when someone talks to me about comparing potential markets and mentions only differences in population but not spending power, I get fidgety.

Noted. I should probably do one on economics per region, since I think a lot about that when I think about how these countries will develop with the help of technology.

Will also note to do some more behavioral economics/consumer psychology as well for these specific regions where major differences stand out.

Good comments, thanks.

“The value a smart phone brings is disproportionate to income levels or the wealth of a nation. Especially when it can help you run your business, provide for you family, etc.”

This is so true. The increase in economic advantage that ownership of a mobile phone (smart phone) conferred to an urban peasant who previously had no access to telecommunication (computers) is much greater than that conferred to a person who already had access to a landline (PC) at home and at work.

In India quality of service of the cellular operators is terrible, that compounds the Value for Money equation even further. With the new government and its plans for a Digital India , we hope that next three years will allow for opportunites that will really show which way the Value for Money equation will tilt.

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

But wanna say that this really is quite helpful Thanks for taking your time to write this.

Thank you for great information. I look forward to the continuation.