I have had the opportunity to spend time with the Surface Duo. A product that certainly has room for improvement, but which I think signals something about the future of mobile computers.

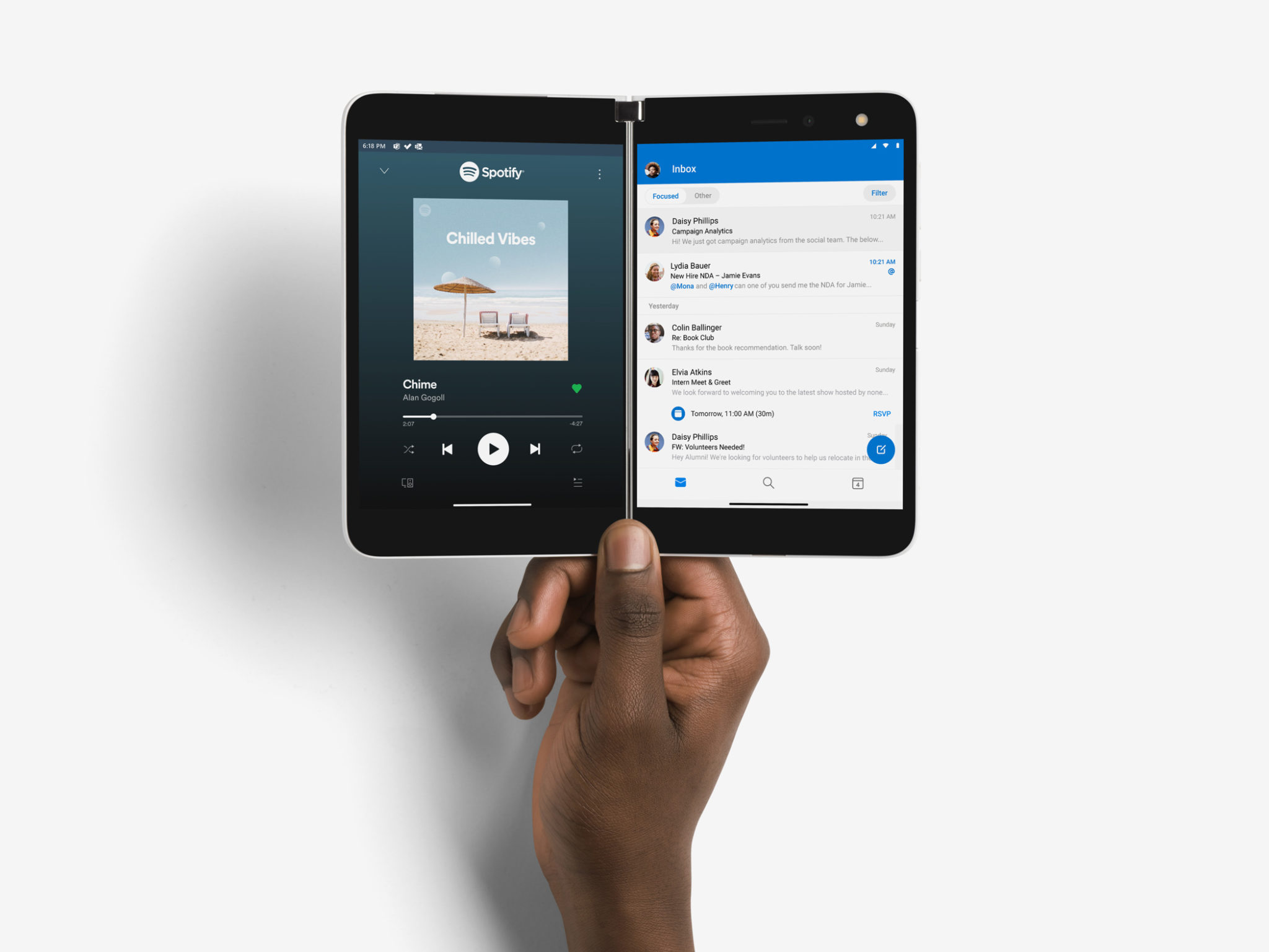

The emphasis from Microsoft was on a true two-screen experience with Duo, which is where the differentiation with this product and it’s most interesting use cases reside. As always, when I use a tech product that brings something new to the table, my exploration focuses on what I can do with this device that I could not do before. With Surface Duo, this was evident from the start where the side by side screens allowed to run two apps together side by side. What immediately hit me about this experience was how it was a mobile experience of my favorite way of working on iPad by using two apps side by side at the same time.

The bigger the screen, the more customers can do with their devices. This is why the notebook/desktop has always been positioned as the ultimate productivity computing devices. But also why the debate with iPad got blurry since it allowed for much better multitasking but on a more mobile device than a laptop and desktop. To that end, those of us who have always study consumer behavior has always been fascinated by just how much traditional computing tasks most consumers do with their smartphones, which has continually led me to conclude that what consumers really want is the most mobile device form factor that they can get the most done with. This is why the Surface Duo is so intriguing to me because it enables a dramatic amount of productivity in a pocketable/pursuable form factor. Which, as I mentioned, I have concluded, is exactly what consumers will continue to gravitate toward and exactly why I’m convinced folding pocketable devices have a bright future.

One of the more difficult parts of testing the Surface Duo was getting ample opportunities to stress test the productivity angle while out and about due to COVID-19 and the reality that many of us are not leaving the house. But I did take it out into the world every chance I got and intentionally took some video calls/meetings while out in the world which, given the work from home moment we are in, actually proved to be one of the more interesting use cases.

We can all relate to the painful amount of video calls/meetings we are all experiencing lately, and to be honest, before using Surface Duo, this is not something I would have considered doing with my smartphone due to my need to be present and on camera as well as take notes. This use case, in particular, is where the side by side apps and increased multitasking function of Surface Duo stood out to me as quite compelling. This use case is also made more functional due to the size of the side by side screens on the Duo, compared to something like the Samsung Galaxy Fold. While the Fold can run apps side by side, the Duo allows a little more real-estate for those essential productivity apps, which was quite empowering and gave me quite a bit of confidence to do more while I was on the go.

Going back to my point about how the Duo brought the most empowering productivity angle of iPad in side by side apps to a more mobile device causes makes me think it is better to think of Surface Duo as a pocketable tablet than a smartphone. The more time I got to use Surface Duo out in the wild, the more this became clear that using it feels more like using a pocketable tablet than a smartphone.

V1 and Software

There was a great deal of conversation around the software with Surface Duo. There were many fair criticisms of the Surface Duo hardware specs, and the greatest challenge for the platform and Microsoft, and Google is to get more apps optimized for the folding mobile device experience. Yes, Duo is a V1 product, but the broad commentary about the hardware was spot on. From a design standpoint, the hardware is amazing. The biggest hardware knock being the camera, which is also fair. But again, if we think of Duo more like a tablet than a smartphone, both the potential customer for this and the broader future of mobile devices becomes clear.

For all the criticism the Duo has taken in software, I think it is worth pointing out that getting the hardware right for this is an equally important task and arguably the first important task. The software can update over time, but hardware can not. In fact, even with the shortcomings in the camera specs on Duo, if this product was running the Google camera that powers Google’s Pixel phones, I don’t think the Duo camera criticisms would have been as negative.

I think Microsoft nailing the hardware design in many regards was the most critical first step on their journey. They are collaborating deeply with Google, which is an interesting side point. And given the bent on the productivity potential of Surface Duo and the fact that most of Microsoft’s productivity suite was highly optimized for Duo, being productive with Office was quite effective.

For Microsoft, this is a marathon, not a sprint. And for Surface, the goal of the Microsoft hardware line was never to be the market share leader in terms of sales but to be a catalyst for innovation and push the Microsoft ecosystem of software and hardware forward. While I am certain Microsoft has more Surface mobile hardware coming, if this product and their collaboration with Google causes the mobile ecosystem to move forward and support more sid by side app usage, then everyone wins. Especially Microsoft, as the more we can all get done in more places for our day jobs the better positioned Microsoft software and services solutions are on all devices.

Workflows

I found the flexibility of folding the Duo over for one screen usage quite compelling when I went to triage email or to enter long text. My biggest complaint was the keyboard for text entry when the device was opened to two screens. A challenge I think, will need to be solved for us to take folding devices more seriously. But that was solved by flipping Duo over into single-screen mode when I could use it more in a context like my iPhone for inputting and feeling comfortable inputting long text.

One very interesting thing I found, was because of some of the challenges inputting text I found myself using voice input more often. It caused me to wonder if this two-screen/folding screen mobile solution may cause more usage of voice as a computing interface and the role of smart assistants whenever it becomes mainstream.

Microsoft also did something with the software that I wish Apple would with iPad. Which was group different apps together so you could launch specific pairings of apps you pre-determine. Essentially I created several dual-screen workspaces with the most common pairings together. I did things like pair Teams and OneNote or Twitter and Edge, Facebook, and Instagram, etc. This way whenever you clicked the app grouping they both launched together side by side.

Ultimately, I land on the same point many reviews did with Surface Duo. It’s not perfect. It will get better (both hardware and software), but by using it, we get a chance to use a bit of the future today.