At CES in 2013, I had lunch with Glen Lurie, then the GM of ATT’s mobile business. At the time, he told me of his vision of equipping all cars with a cellular wireless radio and using this to deliver more intelligence to a car. Part of the vision was to use the cellular radio as a mobile Wifi hot spot but he saw the time when the car’s entertainment system and its diagnostics would need to be tied to wireless communication so it could help carmakers deliver smarter and more intelligent cars. This meeting took place before Apple introduced their Auto Play or Google rolled out Android Auto.

Two years later, his vision is becoming more of a reality with just about every carmaker adding a cellular radio as an option and integrating Apple and Google’s systems or their own to make cars smarter and safer.

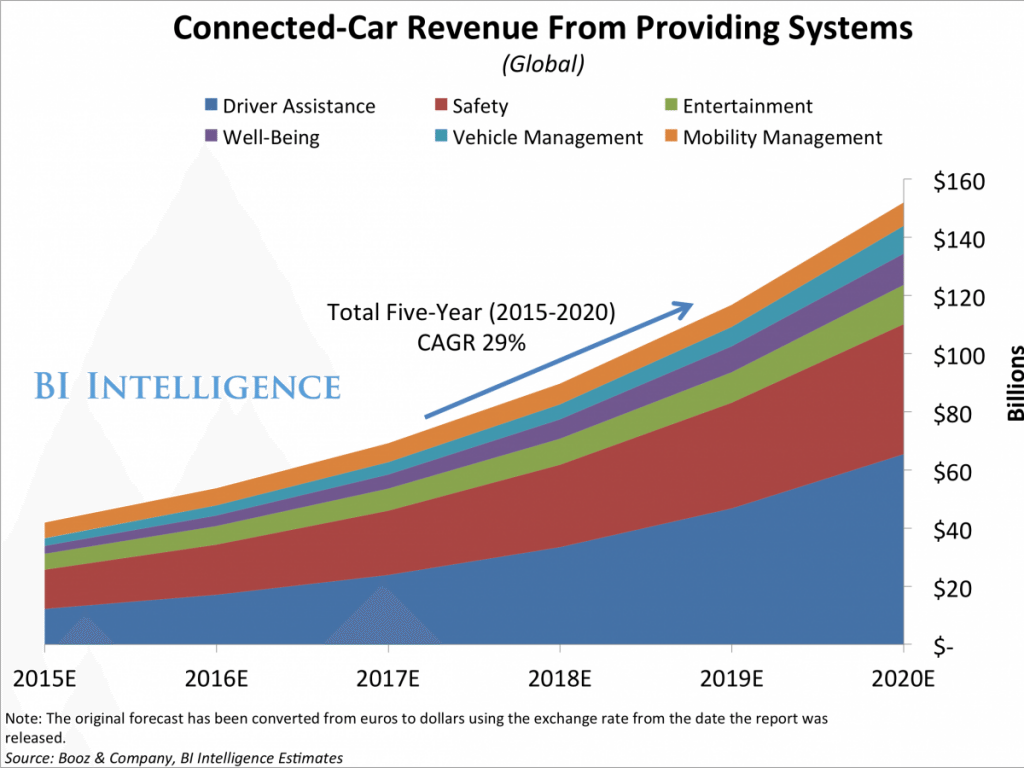

I recently saw a Business Insider report on Connected Car Revenue streams and was intrigued by their forecasts. Here are the highlights of the report:

• Connected-safety features bring in the most revenue of all of today’s connected-car services, at $13 billion. These features alert customers of road conditions, such as severe weather or an approaching hazard, as well as collision avoidance.

• Entertainment is one of the most popular features available for the connected car, but it is not a major revenue driver. The category will account for only $13 billion in revenue in 2020. Entertainment features include integrations with apps such as Pandora, Yelp, and Facebook.

• People who actually use connected car services are satisfied with them. About half of those who have a connected car actually use the car’s connected features and those who do use many of these features show high levels of satisfaction with them.

• Consumers are pretty split on how they want to pay for these services. 25% of global consumers would be willing to receive in-car advertising if it meant they got free basic services in exchange. This means marketers are likely to have a big opportunity to tap into the connected-car market.

You will notice in the chart below that driver’s assistance and connected safety features are projected to bring in the most revenue, followed by entertainment.

The fact safety is at the top of the revenue list should not be too much a surprise as drivers have always considered safety a key priority when they buy cars. But, as I listen to the various automakers outline their short term ideas about increasing driver safety, I am coming to understand that, if this is where the money is, then creating a self-driving car needs to be their biggest priority for the future.

Indeed, if these forecasts are right, people who buy cars are willing to pay extra for safety. If you follow the whole autonomous car concept and study Google’s experience with their driverless car, you can see how these types of vehicles have the potential of being the safest cars on the road in the future.

But I have to admit smart entertainment system revenues in this forecast seem low to me. If a car has Google or Apple’s auto systems and they are tapped into apps and services, it would seem the revenue potential should be more. Also, since most cars on the market today do not have a smart entertainment system built in, the new retrofit kits coming from many of the top line audio companies should surely bump these revenues up.

In fact, I think millions of car owners who have cars without these new connected entertainment systems will want to buy these retrofit systems and/or kits in the next few years. I see those who own iPhones and Android phones wanting to extend these smartphones features to their cars to give them the special apps and services Google and Apple and their app providers will deliver for Apple’s CarPlay or Android Auto. In fact, this may be one of the most untapped and more important market opportunities for auto makers, Apple, and Google when it comes to these special extensions of smartphones.

Although Business Insider estimates that “of the 220 million total connected cars on the road globally in 2020, we estimate consumers will activate connected services in 88 million of these vehicles.” The report also states, “By 2020, nearly 40 million cars will be using Android Auto and 37.1 million will be using CarPlay, according to IHS, and that will cover nearly all cars launching connected car services”, according to BI Intelligence estimates.

But this is just in new cars that have these services built in. If the industry is not looking at the retrofit market in a similar way, they will be missing a big opportunity. I know most retrofit systems today are expensive. But we should see some moderately priced models as CES. I happened to lease my last car before newer cars came out with Apple’s CarPlay in them and I am one of their target customers, along with millions of others that would like to extend their iPhone or Android phone with their car apps to their existing cars. This could be a very large market opportunity that to date I just don’t see the car makers or even the top line audio suppliers pushing to their current customers but I sure hope they get behind this and make it possible for millions of smartphone users to take advantage of these new auto services by Google and Apple.

It’s nice to see the best quality content from such sites.