RECAP

We’re looking at the tablet business models of Apple, Amazon, Google, Samsung and Microsoft. Today we focus on Windows 8 and the Microsoft Surface.

5.0 Windows 8 And The Microsoft Surface

5.1 WHERE DOES WINDOWS 8 AND THE MICROSOFT SURFACE MAKE ITS MONEY?

When introducing the new Amazon tablets, Jeff Bezos said:

“We want to make money when people use our devices, not when they buy our devices.”

Microsoft now has TWO tablet business models. They license their software to Original Equipment Manufacturers (OEMs) and make their money from licensing fees. AND they sell their brand spanking new Surface tablet directly to end users and make their money from the sale of the hardware.

In neither model does Microsoft make (much of) its money from the sale of content or apps.

It’s important to note that in the licensing model, the OEM is the customer and in the hardware model, the end user is the customer. The different models require entirely different – and possibly conflicting – corporate cultures, philosophies and strategies along with different supply, production, marketing, sales, and distribution structures.

5.2 WHERE DOES THE WINDOWS FOR THE DESKTOP BUSINESS MODEL PROVIDE VALUE?

Before we look forward at Microsoft’s tablet business model, let’s look back at Microsoft’s desktop (and notebook) business model.

Microsoft’s traditional desktop business model brought value to their customers in a wide variety of ways. However, it is vitally important to note that Microsoft’s customers were not end users. They were:

— The manufacturers who made hardware;

— The developers who made third-party software; and

— The business IT departments who authorized the large scale purchases of the hardware running Microsoft’s Windows operating system and the software compatible with the Windows operating system.

Licensing Business Model

Microsoft licenses their Windows operating system software to all comers. This allows a multitude of companies to create a wide array of hardware offerings with different shapes, sizes, types, prices, etc. The strength of licensing lies in its variety at the hardware level. The software is monolithic. The hardware is diverse.

Licensing is often considered to be THE reason why Microsoft won the PC wars in the ninties. Licensing allowed for the rapid proliferation of hardware running the Windows operating system. As the number of Windows powered computing units increased, the network effect kicked in and Microsoft’s platform became more and more powerful. Suddenly Microsoft Windows was not a choice, it was the ONLY choice. When one was buying a desktop computer or desktop software in the nineties and the two thousands, the first question asked was whether that hardware or that software was compatible with Windows.

Operating System

Microsoft’s excellent, high quality Windows operating system software provides their cutomers with great value.

Platform

Microsoft maintains the platform for software developers to build upon. The importance of Microsoft’s role in adding value by building and supporting their platform cannot be underestimated.

People mock Microsoft CEO Steve Balmer for his sweaty “developers, developers, developers” chant but he had it exactly right. Ballmer knew that so long as Microsoft took care of their developers, their developers would continue to add ever more value to the Windows platorm and that the more valuable the Windows platform became, the more valuable – and the less vulnerable to competition – the Windows operating system software would be.

As an aside, compare Microsoft’s stewardship of Windows with how Google has treated Android. Google has created a world class operating system in Android but they have done their hardware licensees a disservice when it comes to platform. Their software updates are severely fragmented, their store is difficult to navigate and lacks content and their app store is clogged with clones, pirates and viruses. As a result, Android owners buy less content and apps and Android app developers make far, far less money than do the developers for competing platforms.

Office Suite

Microsoft’s Office Suite is THE standard for business software and THE bedrock upon which most businesses operate. If your hardware or your software doesn’t run the Office Suite, it probably doesn’t run in a business enviornment.

Business Symbiosis

It has already been mentioned that business owners and IT departments, not end users, are one of Microsoft’s prime customers. However, the bond created by Microsoft between their Windows operating system and Business IT departments cannot be overstated. Microsoft catered to IT’s every need and IT reciprocated by making Windows the one and only allowable computing operating system at most small, mid and large business organizations the world around.

Monopoly Superpower

At its height, with as much as 95% market share, Microsoft was, and still remains, THE de facto standard for desktop computing. The benefits derived from this monopoly position are too many to enumerate. The easiest way to sum it up is to say that Microsoft basically had no competition whatsoever and Windows hardware manufacturers and Windows developers only competed among themselves. They had virtually no external competition at all.

5.3 HOW DOES THE WINDOWS 8 AND THE MICROSOFT SURFACE BUSINESS MODEL DIFFER FROM THE WINDOWS DESKTOP BUSINESS MODEL?

It is difficult to project what is going to happen with Microsoft’s tablet business model for at least two reasons.

First, Microsoft’s new, Windows 8 and Surface tablets don’t go on sale until October 26, 2012. Without hard data to guide us, everything is speculation.

Second, I think that, for many, the analysis of Microsoft’s future is clouded by beliefs engendered from Microsoft’s past. Many pundits aren’t so much hoping that Microsoft will advance to a glorious future in mobile computing as they are hankering for Microsoft to return to their glorious past. The glow from Microsoft’s past successes is so bright that it is blinding them to the fact that today’s mobile computing markets are very, very different from yesterday’s desktop computing markets. We need to be certain that we are applying today’s reality to Microsoft’s tablet efforts, rather than being swayed by echos from Microsoft’s fabled past.

The licensing business model is not the same

Microsoft made its name and its fortune from licensing its Windows operating system software to desktop and notebook manufacturers. To say that Microsoft’s licensing model was a success would be one of the biggest understatements in the history of business. However, because Microsoft won the PC wars so convincingly, many industry observers mistakenly concluded that licensing was the one and only viable business model for creating a computer platform. Nothing could be further from the truth.

A business model is merely a strategy, not a guarantor of success. There is no one right business model. Business models have to be adapted to the existing circumstances. What worked yesterday is no guarantee of success. In fact, doing what worked yesterday may very well guarantee failure.

Today’s mobile markets are very different from yesterday’s PC market. The question before us isn’t whether licensing works – it does. The question is whether Microsoft’s current licensing strategy has a place in today’s tablet markets under today’s circumstances.

The licensing fees are not the same

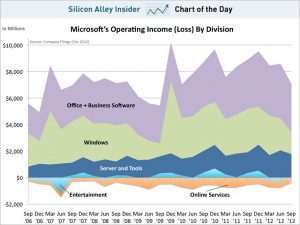

It has been estimated that licensing fees for mobile devices will be lower, and perhaps much lower, than those that Microsoft has been able to command from desktop manufacturers. Microsoft needs to charge less in order to keep their mobile devices from being priced out of the market but they also need to be cognizant of the fact that every reduction in licensing fees is a reduction in their overall revenues.

The good news is that mobile is where all the growth is and if Microsoft can successfully break into the tablet market, they might ultimately make up in volume what they lose on a per device basis. However, while the Apple Mac – with its premium, integrated software and hardware business model – was able to survive and thrive with only a tiny share of the desktop market, licensing models do not do well as niche players. Since licensing business models only receive a small portion of each product’s total revenue stream, they need to be high volume players in order to generate significant income.

Hardware diversity is not necessarily an asset

As previously noted, one of the stregnths of the licensing business model is hardware diversity. But hardware diversity can also lead to customer confusion. And confusion is the enemy of sales.

Microsoft isn’t entering the tablet space with a single tablet entrant. Most of Microsoft’s partners are jumping into the Windows 8 tablet space all at once with a wide and wild assortment of products. Endless choice is nice in theory but real world marketing experts know that too much choice leads to paralysis by analysis, buyer indecision and no sale.

Another concern is the lack of software optimization. With such a wide variety of screen sizes and types, all coming onto the market at once along with the new Windows 8 operating system, it will be virtually impossible for developers to optimize their programs for the numerous hardware form factors. For more on this, I highly reccomentd Ben Bajarin’s artle on this topic entitled: Windows 8 Tablet Fragmentation and the App Dilemma.

Selling hardware is not the same as licensing software

With the introduction of the Surface tablet, Microsoft has entered into an entirely new (for them) business model. Breaking from their traditional model of only licensing their software, Microsoft will, in addtion to licensing their tablet software, be selling tablet hardware as well.

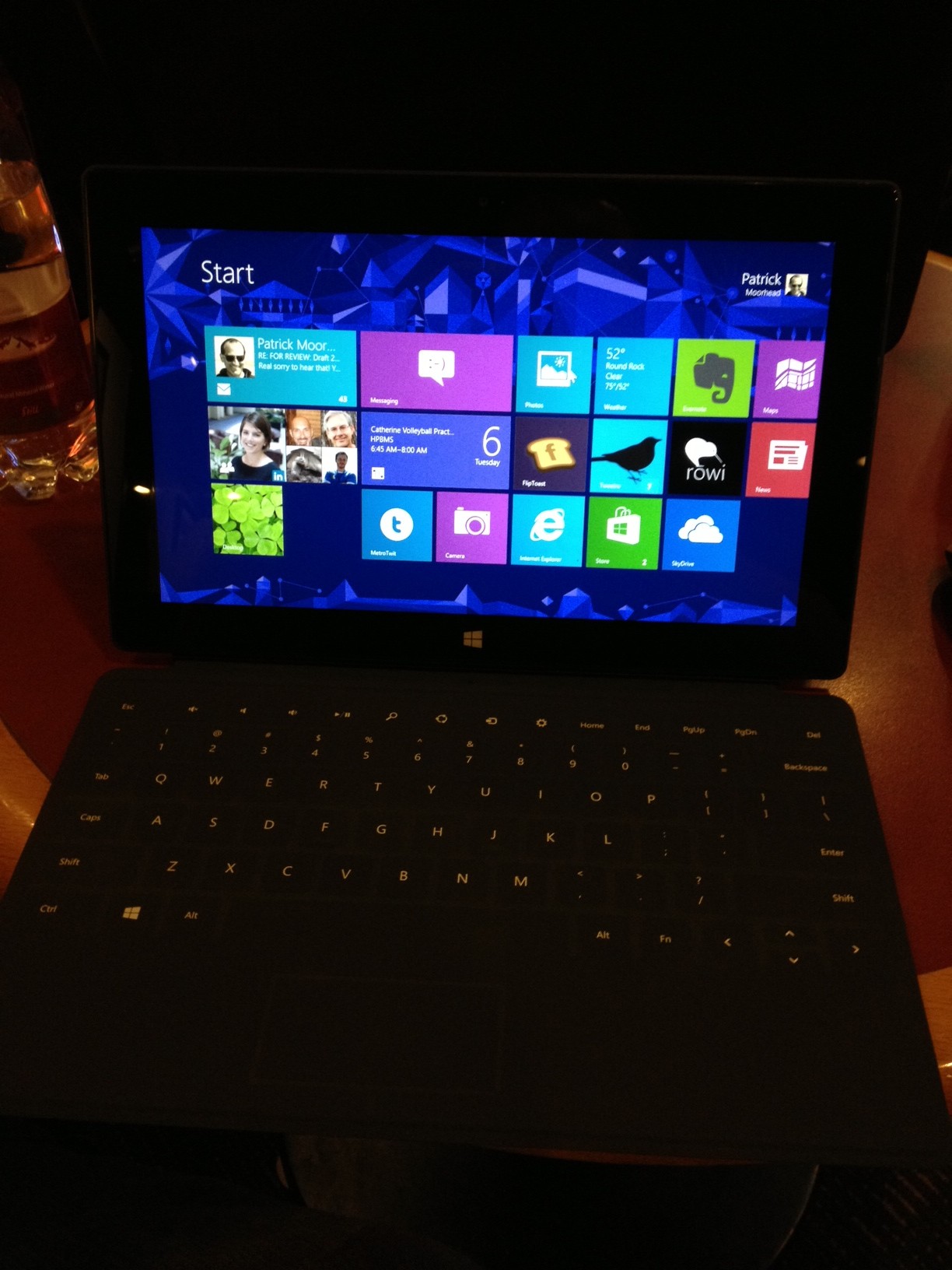

Microsoft has some experience with the creation of hardware (Zune, Xbox) but it can’t be considered a core competency. And their unwillingness to reveal details about the pricing and specifications of the Microsoft Surface, plus their almost paranoid refusal to let anyone outside of their inner circle play with or even touch the unit, has to raise doubts about the devices readiness.

With regard to the quality of the Surface hardware, I’ll give Microsoft the benefit of the doubt. But until we finally get units in the hands of independent reviewers, the doubt will still remain.

Desktop applications are not the same

Desktop applications running on Windows 8 tablets is a huge differentiator for Microsoft. But does it truly bring value to their users?

Ten long years of bad experiences with Microsoft tablets have taught us that desktop applications do not work well on tablets. Yet Microsoft perseveres in their belief that desktop applications DO have a vital role to play on the tablet form factor. We’re about to have an epiphany or Microsoft is about to re-learn a very expensive lesson.

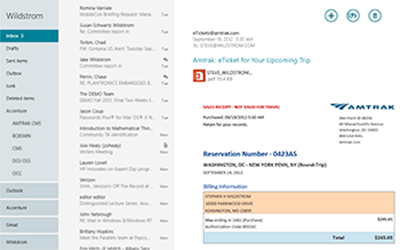

Tablet apps are not the same

Microsoft wants to bring value to their users with tablet apps the same way that they brought value to their desktop users with desktop applications. They know, better than anyone, that a modern software ecosystem needs a large number of apps to be successful. It’s the very reason that their Windows platform dominated computing for the past twenty years.

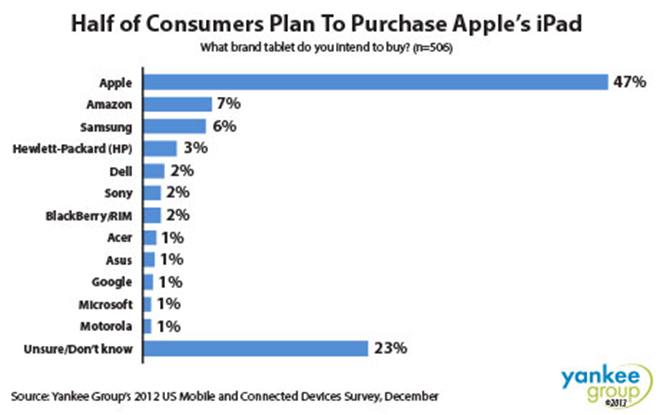

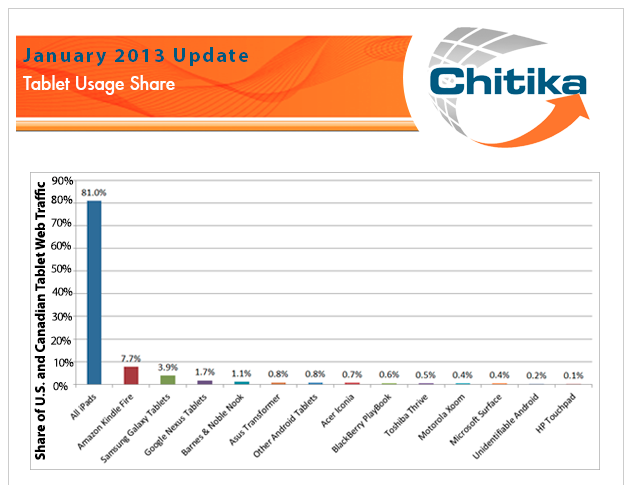

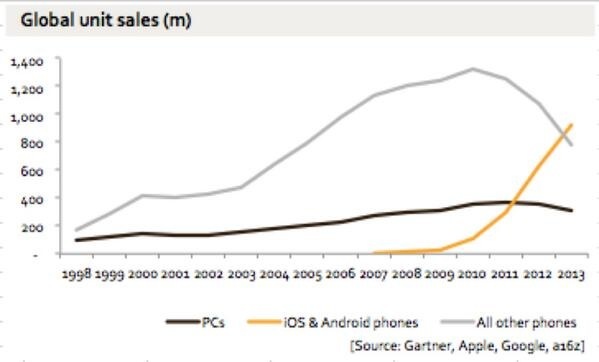

However, Microsoft is very, very late to the tablet game. Modern touch tablets may only be two and a half years old but tablets have been adopted faster than any technology in history. Studies show that 25% of Americans own a tablet. Further, while tablets may only be two and a half years old, the modern day app platform started four and a half years ago, in April 2008, with the iPhone. While Windows 8 is entering the market with between 2,000 and 10,000 apps, the Android and iOS platforms boast 700,000 and 750,000 apps each. And iOS has some 250,000 apps specifically optimized for use on their tablet products.

The low number of apps is a catch-22 for Microsoft. Developers don’t want to develop until a platform has enough users, while users don’t want to buy your tablets until you have enough apps. Users of iOS and Android devices won’t have much patience with Windows 8 either. Why should they wait for a barren Windows 8 store to fill with product when they can buy from the fully stocked Android and iOS app stores today?

Microsoft is the master of creating developer relationships but, shockingly, they have failed to successfully woo developers to the Windows 8 platform. Microsoft has actually resorted to PAYING developers to develop for the platform. This is very telling.

With platform, developers are the canaries in the coal mine. We can gauge how well the platform is doing by measuring how well the platform’s developers are doing. And right now, developers are telling us, in no uncertain terms, that they have no confidence in the platform. They are waiting to see if the platform will be successful before they commit. And with platform, a “wait and see” attitude is the kiss of death. The longer they wait, the less likely it is that the platform will succeed.

It’s still too soon to definitively say that Windows 8 won’t attract developers. But the time needed for Microsoft to build a successful platform is running out and it’s running out fast.

The Office Suite is not the same

On the desktop, Microsoft’s Office Suite is THE standard for business software and THE bedrock upon which most businesses operate. Many believe that it will be Microsoft’s killer app for tablets too.

The problem with that theory is that it totally ignores the divide between the touch input demanded by tablets and pixel specific mouse input demanded by the vertical screens used by notebook and desktop computers. Windows Office is optimized for desktops. The more Microsoft tries to make it work on tablets, the less like Windows Office for the desktop it will become. Windows Office will not be the killer app for the tablet because by the time it works properly on the tablet, it will have morphed into a entirely different program.

Even worse, from Microsoft’s perspective, is that Microsoft Office has lost its cachet among smartphone and tablet users. The past year alone has taught 650 million smartphone users and 100 million tablet users that they can get by just fine without the need to use Microsoft’s Office Suite.

Microsoft’s symbiosis with businesses is not the same

Many pundits are expecting IT to embrace the Microsoft tablet in the same way that IT embraced Microsoft Windows for the desktop. The problem with that theory is two-fold.

First, times have changed. In the ninties, businesses standardized on the Windows operating system and then consumers followed suit. Today, consumers are making many of the critical buying decisions. Consumerization and Bring Your Own Device (BYOD) to work are trends, not fads.

Second, Windows tablets aren’t attempting to replace an unpopular product. The Apple iPad, for example, has user satisfaction ratings in the high nineties. And in only two and a half years, many businesses are already finding the iPad indispensible.

When it comes to business, Apple’s popular iPad tablet is viewed as a critical tool…

“No one doubts the device’s popularity, but what’s really eye-opening about these statistics is just how inextricable the iPad has become from (business) users’ everyday lives. ~ Brainshark

Windows 8 tablets may or may not do well in business and the Enterprise but we’re never returning to the days when Microsoft dominated IT and IT dominated all the computer purchase decision-making.

Microsoft’s monopoly is not the same

Microsoft Windows and the Microsoft Office Suite may or may not be the best software in their respective fields but users are familiar with them. No one likes to relearn how to use a software program or a user interface. Users benefit from the consistency in Microsoft’s products and Microsoft benefits from the fact that end users are comfortable using their products. This is one of the reasons why Microsoft has been able to maintain its massive market share among desktop users.

But that was yesterday.

A Q4 2011 Forrester survey of 9,900 employees around the world found the average employee used two and a half devices for work. Thanks to gains by Apple and Google, only 63% of respondents reported using a Microsoft OS on one of their work devices.

That is some startling information. Let’s break it down for further examination:

— The average employee uses two and a half devices for work. Wow. And since Microsoft is found mostly on desktops and noteboks and found almost not at all on smartphones or tablets, that means that almost all emploees are now spending some of their time on a non-Microsoft device.

— If 63% of respondents report that they ARE using at least one Microsoft device that means that 37% of employees ARE NOT using ANY Microsoft device AT ALL.

Microsoft still dominates desktops but it’s no longer a computing monopoly. Not by a long shot.

Today’s computing world is filled with not just desktops but with smartphones and tablets too. Phones and tablets are touch devices that have wholly different user interfaces than do desktop devices. If you’re going to have to learn an unfamiliar user interface anyway, you look to learn the best. Without its monopoly power, Microsoft’s products have to compete on the merits. And no matter how good Microsoft’s products are, competing on the merits is a very different – and far more difficult – proposition than being the default choice or the only choice.

5.4 WINDOWS TABLET BUSINESS MODEL – A HOUSE DIVIDED AGAINST ITSELF

Too Many Agendas

A company’s business model often dictates the end user’s experience.

— Apple wants to provide its end users with the best user experience possible because they want to sell as many tablets as possible.

— Amazon Kindle Fire and the Google Nexus 7 are willing to sacrifice some the end user’s experience by including advertisments and focusing their tablets soley on their stores, but they hope to make up for it with the lower prices of their tablets.

— Microsoft’s traditional business model was aimed at IT departments, not end users. IT departments wanted control and features designed specifically for their use and they got it. This sometimes led to a less than optimal end user experience. Microsoft was happy to provide end users with the best experience possible but not if it meant offending their real customers, the IT departments, who made the large scale purchasing decisions.

Microsoft’s current tablet business model is dictating a compromised end user experience. The problem with Windows 8 on tablets is that it isn’t a platform, it’s an agenda.

Mobile is the future of computing. Microsoft needs to get in the tablet game or they are going to be shut out of mobile and shut out of the future of computing. Today, Microsof has virtually no presence in mobile computing. What they do have is a massive presence in desktop computing. Windows 8 is all about leveraging Microsoft’s massive desktop market share in order to gain a foothold in mobile computing. This might be good for business but it is not necessarily good for the end user. Microsoft’s business model is not aligned with the welfare of the end user. And in the long run, that’s bad business.

Too Many Business Models

Microsoft is employing two incompatable business models to sell their tablets. They are licensing their software to manufacturers and they are competing with those same manufacturers by selling their own Microsoft branded Surface tablet. This is similar to what Google is doing with the Nexus 7.

First, Microsoft is competing with its own partners. That’s never a good thing. Even Microsfoft acknowledged the problem in an SEC filing:

“…our Surface devices will compete with products made by our OEM partners, which may affect their commitment to our platform.”

Second, licensing to manufacturers and selling directly to end users requires two entirely different, and oft-times redundant, business structures. Supply, production, distribution, marketing, advertising and sales are all totally different. Just to illustrate the point, Microsoft’s retail stores make perfect sense for selling their hardware to consumers but they serve no purpose at all for licensing their software to manufacturers. Compare this to Apple whose retail store sells virtually every product that Apple makes.

Third, conflicing business philosophies, strategies and cultures do not bode well for Microsoft. One of the reasons that mergers and acquisitions so often fail is because it impossible for the two companies to align their corporate values and culture. One of Microsoft’s greatest strengths was that they knew who they were and what they stood for. Who and what are they now?

Fourth, and perhaps most importantly, Microsoft’s dual strategies show a lack of focus, a lack of direction. They’re improvising.

The purpose of a business model is to direct and guide one’s actions – to be able to foretell a possible future and to act in order to make it so. Multiple, conflicting business models accomplish just the opposite. They are not the embodiment of a strategy, they are the abandonment of strategy.

Summation

I’ve spent an awful lot of this article talking about what can go wrong with Microsoft’s tablet business model. Now let me tell you what might go terriblly right. Microsoft might succeed with tablets DESPITE the flaws in their business model because there is no one standing in their way.

Oh sure, Apple is the 900 pound gorilla in tablets. But they’re not going to acquire 95% market share the way Microsoft did with desktops. Amazon and Google’s business models seem directed at content, not apps. Their subsidized, ad supported models have inherent limitations and are not going to appeal to government, business or education entities. If you want a tablet for serious computing, and you want an alternative to Apple, Microsoft might be your go to guy.

If you want to know whether Microsoft’s tablet strategy will or will not succeed, forget everything else and focus on developers. If developers start to make significant money, if developers start to develop apps for Windows 8 first or even second, if the Windows store starts to fill up with high quality apps that are equal or superior to those of their rivals – then Windows 8 is going to do just fine.

Microsoft’s greatest fear should be that Windows 8 for tablets becomes another Windows Phone 7 – a platform with high quality hardware, excellent software, few developers and even fewer users.

Next

We’ve now looked at the Apple, Amazon, Google, Samsung and Microsoft tablet business models. Tomorrow, we wrap up the series by seeing what the various business models can tell us about the future of tablet computing.

Microsoft – like World War II Japanese soldiers stranded on deserted islands – continued to pretend the war was ongoing while everyone else went about the business of post-war reconstruction. Not only had Microsoft lost the post-PC wars, but their insistence the world was still fighting the PC wars jeopardized their possibilities in the post-post-PC world, as well.

Microsoft – like World War II Japanese soldiers stranded on deserted islands – continued to pretend the war was ongoing while everyone else went about the business of post-war reconstruction. Not only had Microsoft lost the post-PC wars, but their insistence the world was still fighting the PC wars jeopardized their possibilities in the post-post-PC world, as well.