I’ve received a number of questions from readers about why I don’t talk as much about the US market for smartphones. It’s primarily because the US doesn’t offer any new interesting questions or problems. It’s about a 50/50 split between Android and iOS and Apple controls over 60% (and growing) of the premium smartphone space. iOS is on track to gain share into Android’s each quarter of 2014 and it will likely be more of the same in the US in 2015. However, other markets like India and China pose much more interesting questions and problems to be solved. I’ll do a few deep dives on the US market with some of our updated data sets, but what we find will likely not contain major surprises. Now, onto the iPhone and China.

First, Android Context

A fascinating data point came from Baidu yesterday. Baidu, the largest browser in use with an over 80% share in China, reported to Tech In Asia that they count 386 million active, individual Android customers. This is Android AOSP, not Google-approved Android, and a few things are unclear about the numbers. First, it is uncertain if these are smartphone-only owners. The report simply states active Android devices. Given China runs both AOSP on smartphones and tablets sold there, either device connecting to the Internet and accessing Baidu’s search engine would be counted. Through my supply chain checks, I learned that, on average, about 20m low cost Android tablets are sold in China each year. As I have discussed before, most of those are used simply as portable media players and large percentages likely do not connect to the internet. Which means, while some of the 386m active Android devices are tablets, the majority are smartphones. ((Even if the report said they were all smartphones, I would still believe a small percentage were tablets since my research there found that even 7-inch tablets in China use smartphone components; therefore they show up in analytics as smartphones.))

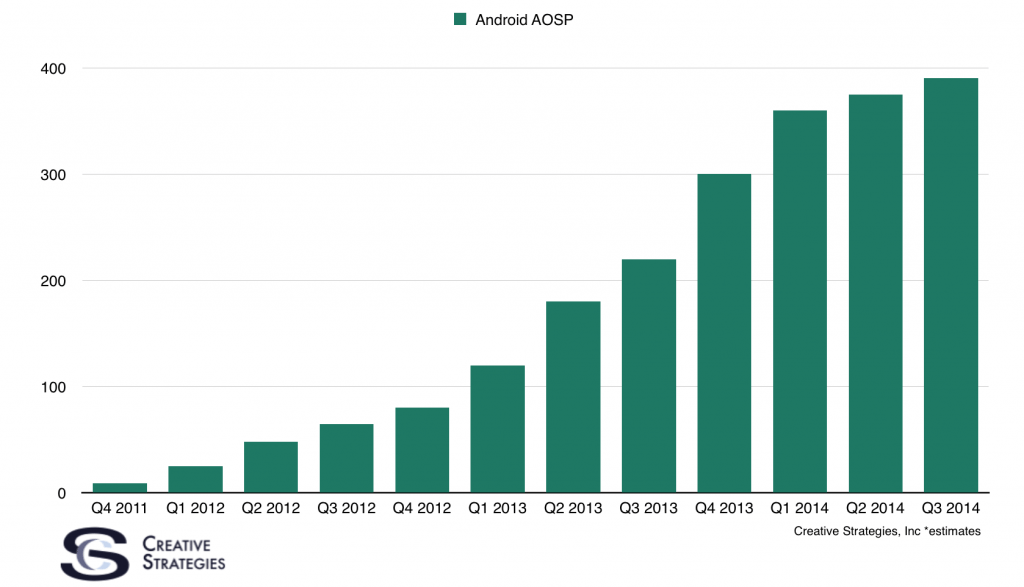

Baidu similarly reported last year a total of 270m active Android users. So there is impressive growth for AOSP. For some time now, I have been building a model of AOSP’s growth in China and was pleased to see Baidu’s data for Q3 2014 matched very closely to my own model.

You’ll note growth is slowing, as is the China smartphone market in general. There is certainly more growth to be had as more of rural China gets online, but these will mostly be with very low cost smartphones. Where things start to get interesting is when we look at the nearly 400m Android AOSP customers in light of the total smartphone user base. A number of Chinese research firms like iResearch China and analytics engines like Baidu/Umeng came out and said over 550m smartphones were in use in China by the end of June of 2014. My model would estimate that number to be around 575m as of today. Now we turn to the iPhone.

All local app analytics sources I have access to in China, and major network statistics I see, show Android and iOS as the two dominant smartphone platforms. So, if ~386m of them are on Android, then the iPhone fills most of the gap between 386m and ~575m. Based on my model, I had estimated iPhones were likely in the 130-150m range and I have believed for some time there were more iPhones in use in China than the US. It seems Baidu’s data is confirming much of what I thought my model was suggesting was true.

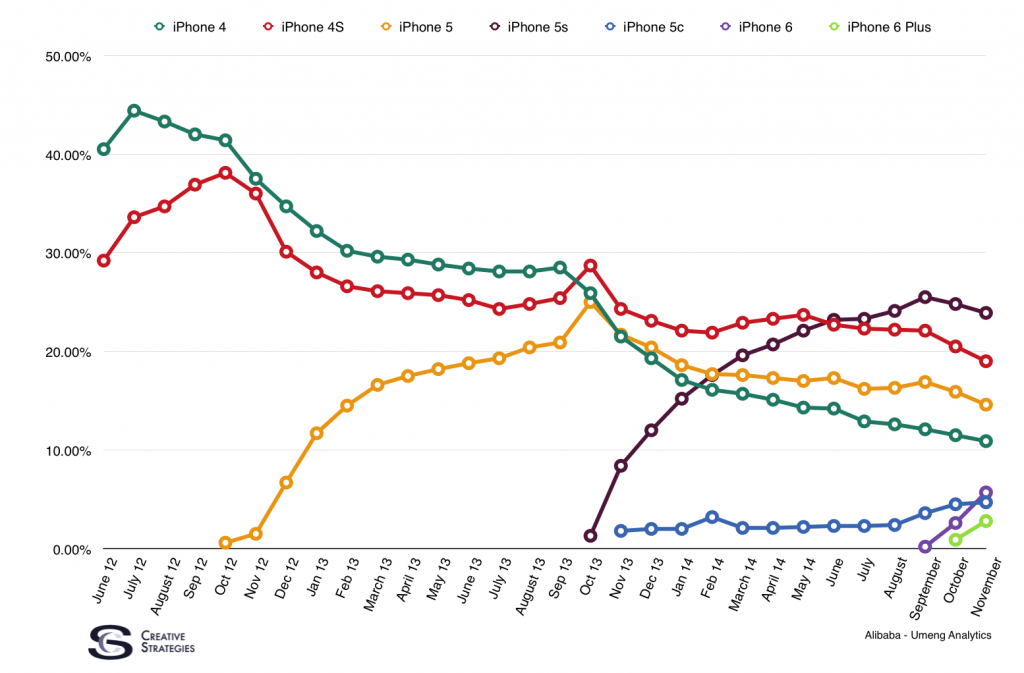

However, the bulk of that iPhone active installed base is on much later generation hardware sold through the grey market. This chart is the most updated data — now containing a a month and a half of iPhone 6/6 Plus availability. Keep in mind iPhone 6s starting showing up in September in this data because of grey market imports.

As Apple offers more models for sale in China, we are seeing the continued rise of primary market sales of iPhones. There remains a large installed base of later generation phones but, as you can see, it is actually more of a mix than domination by a few models. This data comes from Baidu’s app distribution network so it does not cover the entire market but it does cover over 100m devices. I can’t imagine the picture is much different on other app distribution platforms.

What I’m left thinking about is what will happen with the large percentage of current iPhone owners who are using later generation iPhones they bought from the secondary market for prices around $300-$400. It is hard to believe every one of those owners can afford a $700 phone but will they stay in the Apple camp and get another later generation phone like the 5s? Or will they stay in their price range and go with Xiaomi? These will be interesting questions for most of 2015. However, once the current iPhone 6/6 Plus gets discounted in China when the iPhone 7 comes out, I think Apple’s offering in China will be very competitive.

Lastly, it is worth pointing out the China smartphone market is unlike anything out there at the moment. Much of it has to do with WeChat. WeChat is undeniably functioning as an alternate or “para” operating system that runs on iOS and Android. As I look at what lock-in Android AOSP, or Xiaomi’s Android skin, or Apple’s ecosystem has, I observe the true lock-in in China is WeChat. Apple has the benefit of playing as a luxury brand; status is a huge part of their lock-in in China. But as this financial analyst correctly points out, we are hoping to see Apple continue to create more services/cloud lock-in rather than just status. Services like UnionPay integration will help with this but Apple’s services stickiness in China is a story to watch.

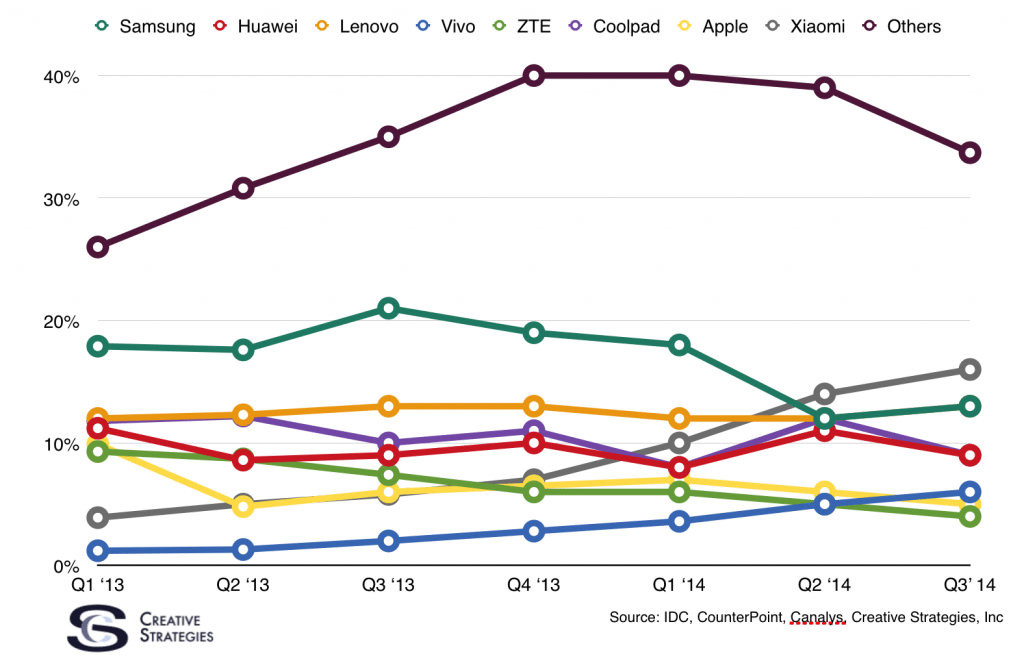

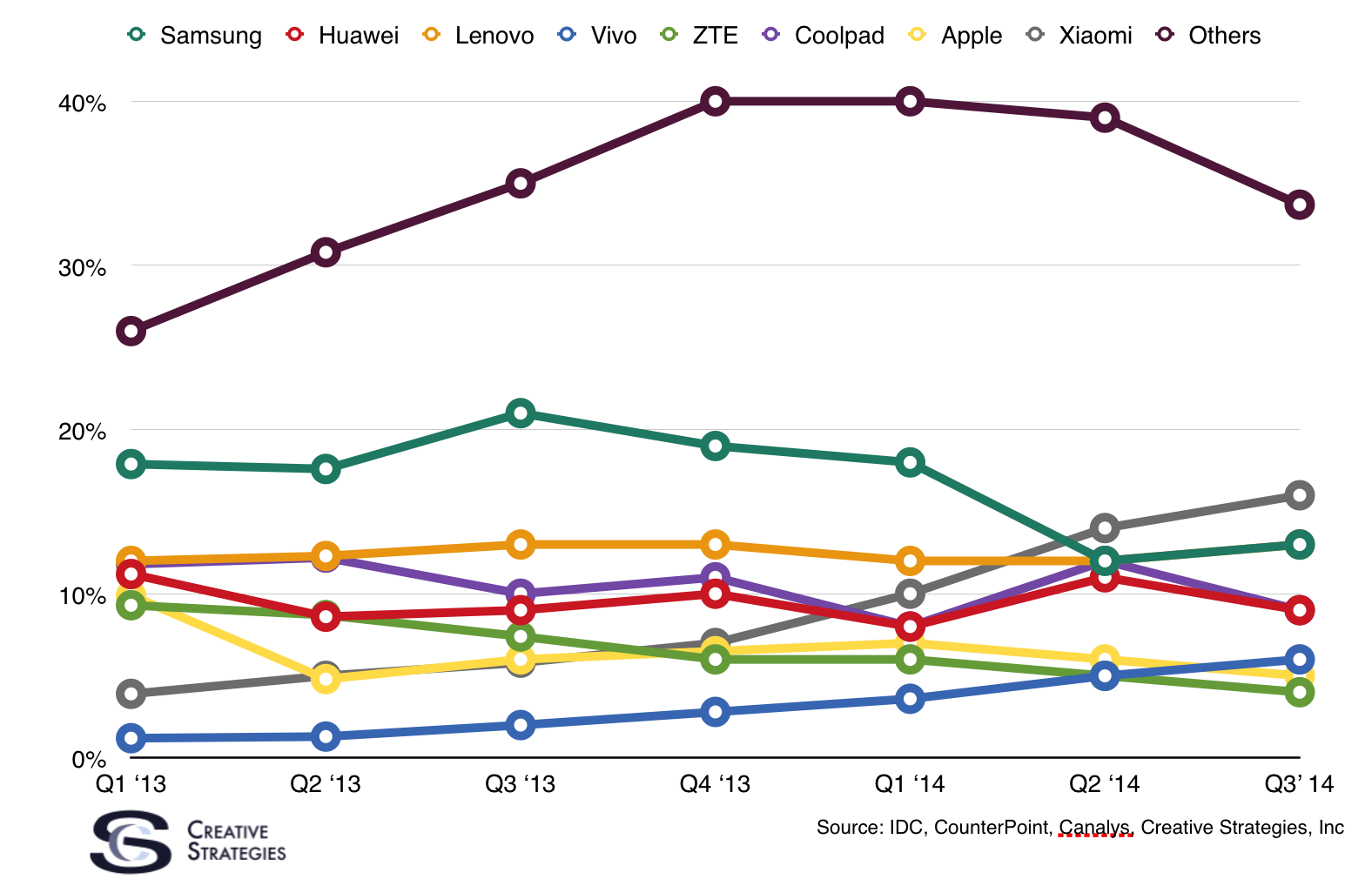

With Chinese consumers’ loyalty to WeChat, it means Android vendors could come and go. Xiaomi is doing a decent job building some loyalty and all on-the-ground research I get from China indicates a growing pride of Chinese consumers for local Chinese tech brands. This will continue to pose challenges to Samsung. We are watching a number of Chinese brands closely, but Vivo (charted below) is one to keep an eye on as they are positioning a number of their products to the high end.

There are many story lines to watch and analyze throughout 2015 with regard to China and I’ll keep updating my narratives on all of them.

I have had the privilege of traveling to about 55 countries as part of my job over the last 30 years. And while I really enjoy Italy, France, Hong Kong, and Singapore, the one country that fascinates me the most is China. I first went to China in the early 1990’s, just when they were starting to establish their special trade zones. At that time the government was still leery of outsiders and we could not travel anywhere without a personal guide of some sort.

I have had the privilege of traveling to about 55 countries as part of my job over the last 30 years. And while I really enjoy Italy, France, Hong Kong, and Singapore, the one country that fascinates me the most is China. I first went to China in the early 1990’s, just when they were starting to establish their special trade zones. At that time the government was still leery of outsiders and we could not travel anywhere without a personal guide of some sort.