Introduction

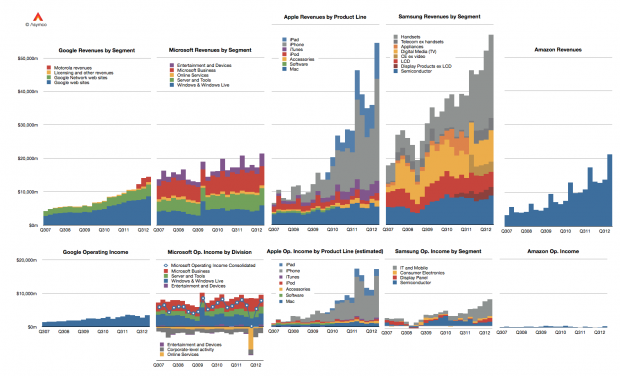

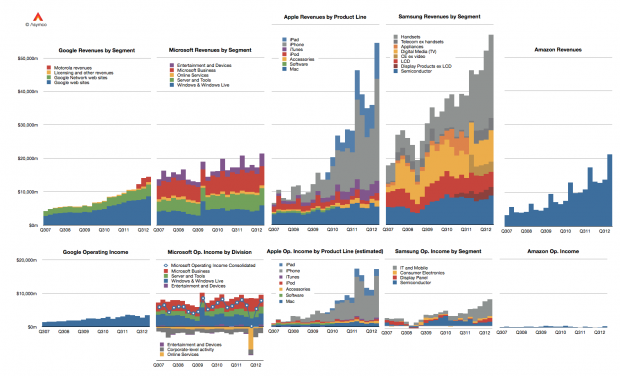

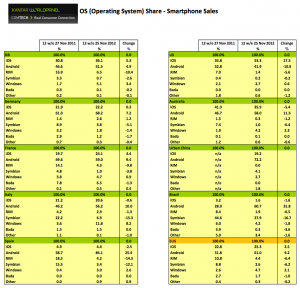

Today’s five Titans of personal computing are Google, Microsoft, Apple, Samsung and Amazon. Horace Dediu of ASYMCO has created a side-by-side comparison of their respective revenues and profits.

Google is a money making machine, but I think that many overestimate its profitability. As the graph clearly shows, Google doesn’t make nearly as much profit as does Microsoft, Apple or Samsung.

Further, we know that the vast majority of Google’s profits are still derived from its desktop advertising business. Android, for all its success in the marketplace, has not yet proven to be profitable to Google.

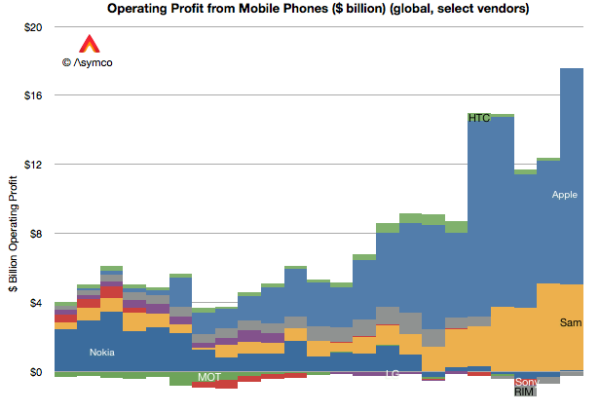

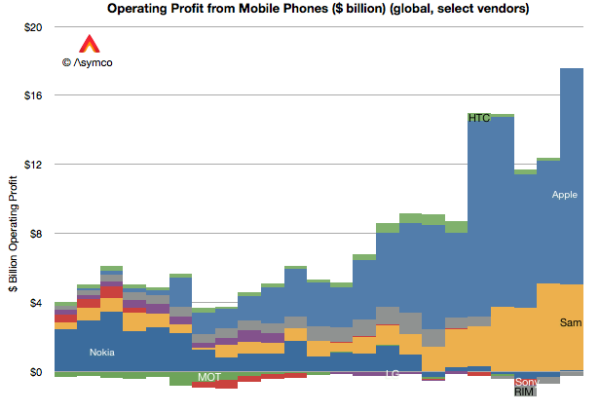

In a reversal of Microsoft’s business model over the past twenty years, all of the Android profits currently reside with the hardware makers rather than the software provider. Perhaps this is why Google is moving more and more towards making their own hardware. (Google currently owns Motorola and makes Nexus phones, Nexus tablets, Chromebooks and the newly minted Google Chromebook Pixel.)

Microsoft

Microsoft has been making ungodly profits for almost two decades. Microsoft’s problem isn’t profitability, it’s growth. Despite making money hand over fist, Microsoft has been unable to grow its base for much of the past ten years.

And Microsoft is facing serious challenges to even maintain the profits that it now has. In the above graph, the red portion of Microsoft’s profits come from Microsoft Office and the blue portion comes from Microsoft Windows. Both currently reside primarily on desktop and notebook machines. With those devices declining in sales and with phones and tablets rapidly growing in sales, Microsoft needs to make the transition to mobile and they need to make it fast or their two cash cows are going to be isolated and start to dry up.

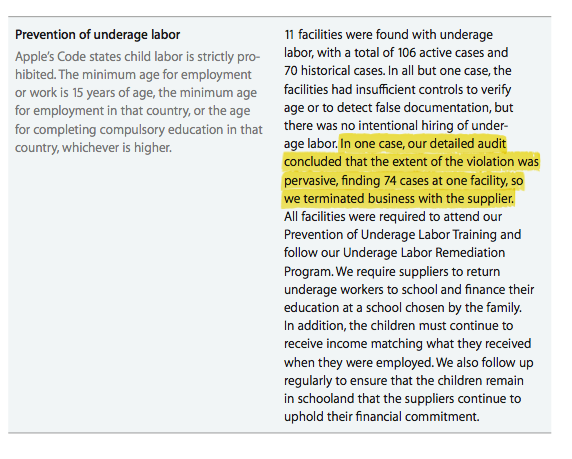

Apple

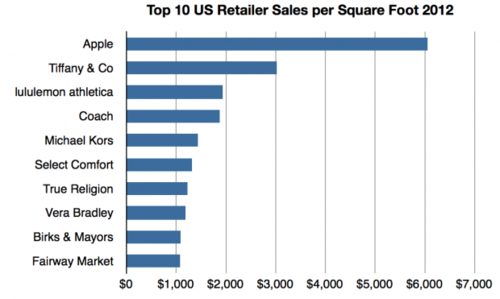

As you can see from looking at the graph, Apple’s profits are not just good, they’re spectacular. They far outdistance the other four titans of tech. At yesterday’s shareholder meeting, Tim Cook reputedly said that Apple grew revenue by about $48 billion, more than Google, Microsoft, Dell, HP, RIM, and Nokia combined.

Apple’s problem is the perception that they are the next Microsoft – that they will continue to make great profits but that their growth will stagnate. The graph, above, does not seem to support that view, but past performance is not a guarantee of future profitability.

Samsung

Samsung is an amazing story in oh so many ways. By all rights, Samsung shouldn’t even be on this list of Tech Titans. For the past two decades, the PC manufacturers – the Dells, HPs, Lenovos, Samsungs, etc – were at the bottom of the tech totem pole. Always trapped in a race to the bottom, Microsoft and Intel took all the profits while the hardware manufacturers were relegated to fighting for the scraps.

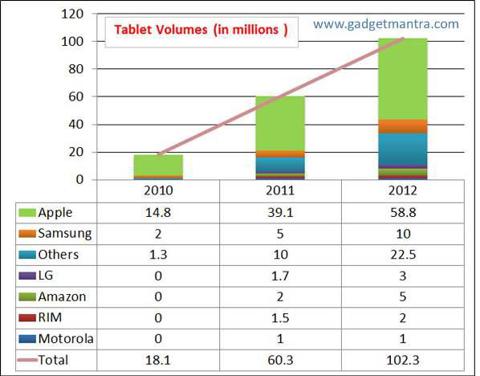

No more. Samsung has turned that business model on its head. Android – like all licensed operating systems – was supposed to encourage a wide variety of hardware providers. But Samsung has swallowed the Android market share and the Android profit share whole.

Amazon

What can one saying about the amazing Amazon. Their revenues go up but their profits do not. And the less profit they make, the more successful they are perceived to be.

John Gruber once described Amazon as the crazy guy at the poker game. You simply don’t know how to play your cards against Amazon because they don’t play by any of the known rules. And you sure as shooting don’t want Amazon to come after you because they will sacrifice profits in order to win your market. And they are relentless.

Summary

So long as Apple is profitable and their ecosystem healthy, they’re not going anywhere. Microsoft is in it for the long run too. They have the money to sustain their efforts and they well know that they need to be in mobile or they will be locked out of the future of computing. Amazon appears determined to be part of the mix too.

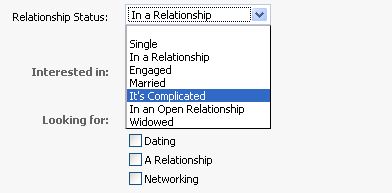

The two titans that seem the most unstable to me are Google and Samsung. Google controls the Android operating system and the ecosystem but they make little profit from either. Samsung makes almost all the profit from Android, but they have little control over the operating system and they make little to no money from the sale of advertising, apps or content sales. That seems like an unsustainable relationship to me. Something has got to give and it’s clear that each side is weighing their options. Google is moving more and more towards making their own hardware and Samsung is flirting with a variety of different operating systems. The future is always uncertain but it seems clear that the relationship between Google and Samsung is certain to change.