Perhaps I should have titled this “India Is The Future Of The Smartphone Wars”?

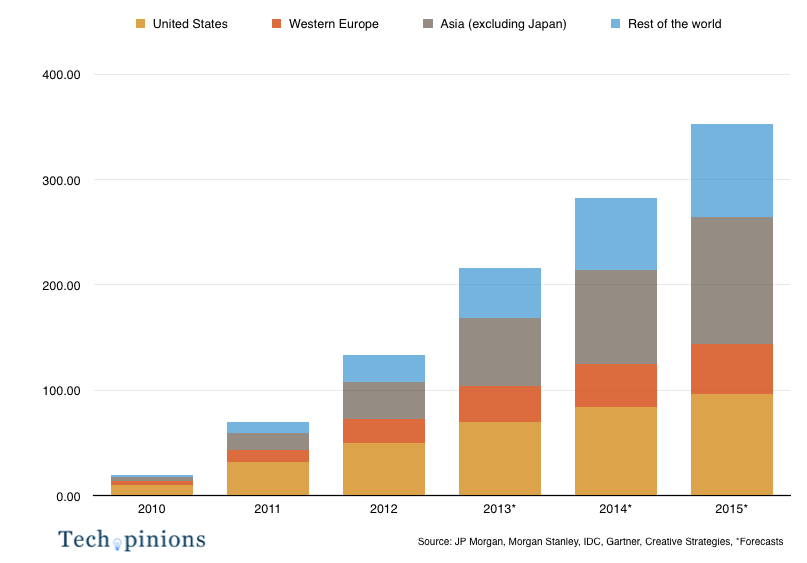

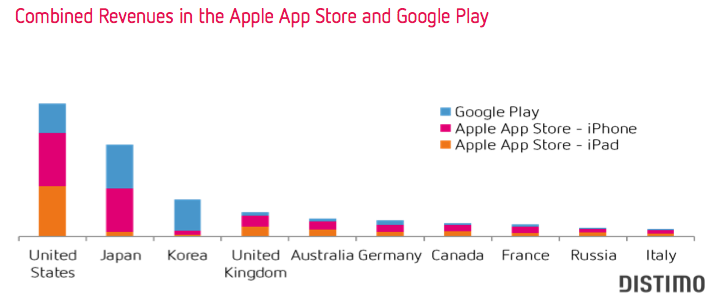

The appointment of the highly capable Satya Nadella to lead Microsoft only partly explains why I am thinking more about India and technology. The other reason is that it increasingly appears that the future of smartphones, and the winners and losers of the global smartphone wars, will be determined in large part by what happens in India. Great news for Google, possibly even for Microsoft and Nokia. Less good for Apple.

Despite the rather remarkable success of Indians in Silicon Valley, many of whom, like Nadella, are now leading tech companies, I still meet far too many analysts who remain disproportionately focused on what’s happening in China, or in Europe, while steadfastly ignoring the speedy, highly iterative tech landscape in the world’s second-largest nation.

Consider the following about India:

- There are over 1.2 billion people — that’s about 4 USA’s

- The median age is 25 (China’s median age is 36 and the US is 37)

- India is the world’s 11th largest economy — and still one of the world’s fastest-growing

- Annual per capita income is a dismaying $4,000 (by comparison, China’s is $10,000 and in the US it is $53,000)

Populous, young, growing, eager for technology, eager for connectivity, albeit with relatively meager resources to spend. It seems to me that is the perfect mix for disruption. Likely, this disruption centers around what is now our most important tool, the smartphone.

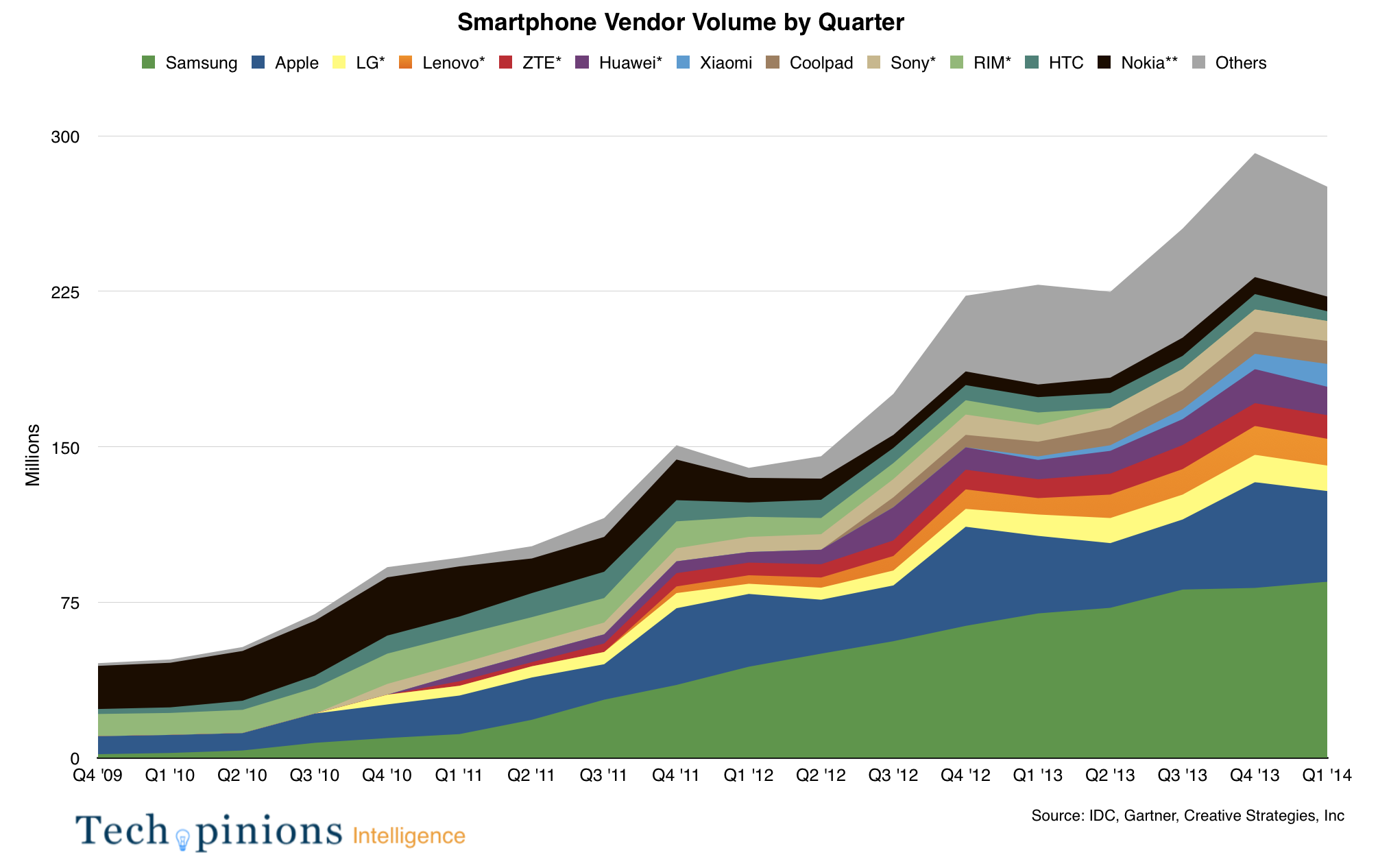

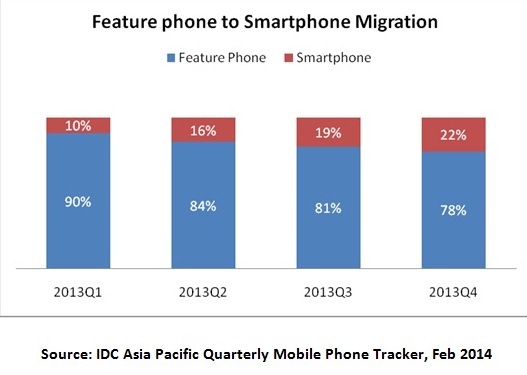

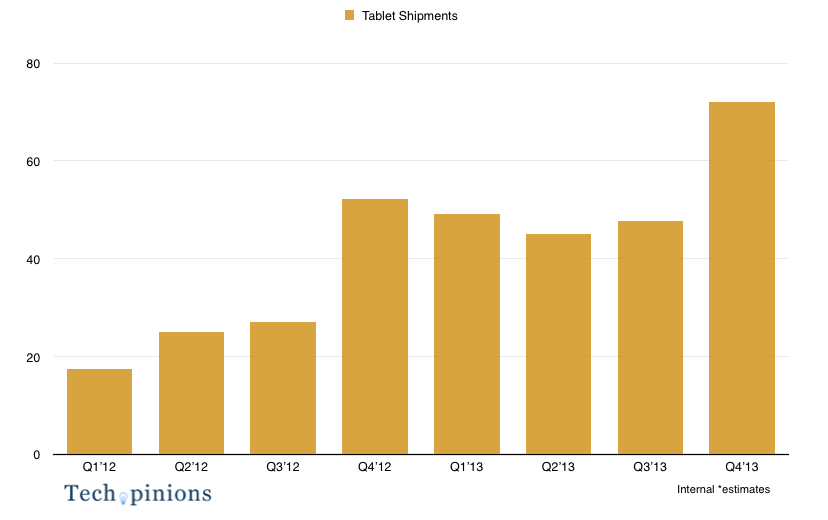

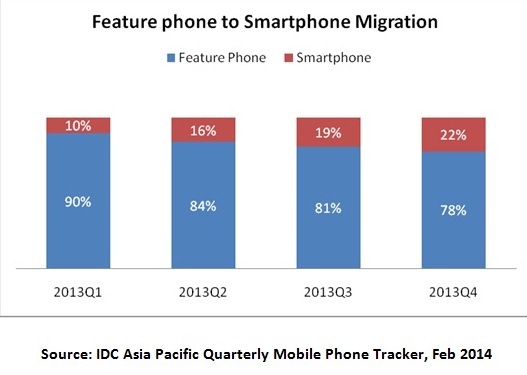

There are already about 150 million total smartphone users in India. Despite that number, and despite the nation’s large population, India is the world’s fastest-growing smartphone market. The giant feature phone market is collapsing.

According to IDC, 44 million smartphones were sold in India in 2013. Phablets (smartphones between 5-6.99 inches) garnered at least 20% of the Indian smartphone market, though other sources place this number much higher.

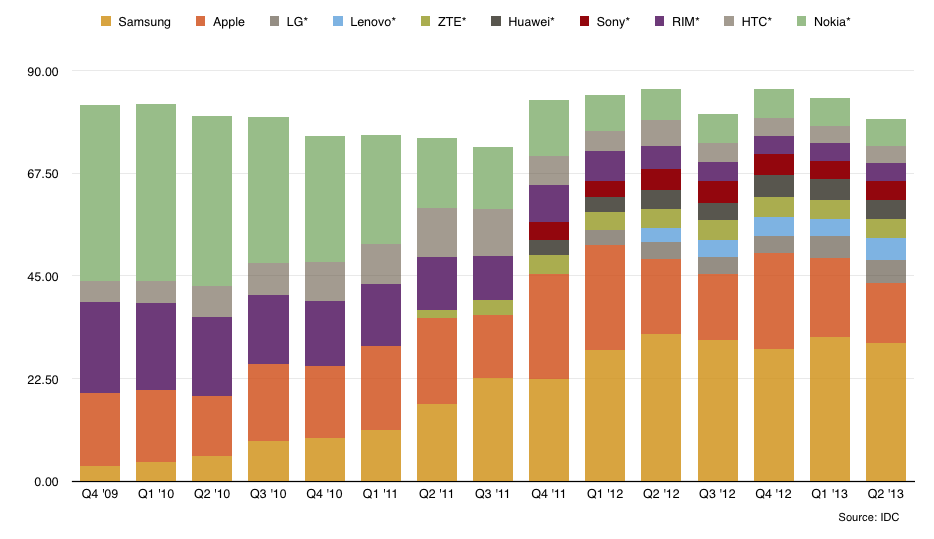

Using IDC’s latest data, Samsung is the leading smartphone company in India, with India-based Micromax and Karbonn trailing. (Nokia, a leader in feature phones in India lags, though sales of its Lumia devices have steadily increased and the company now may have a 5% share of the market there.)

Given the size of the market, and its rapid growth, and the number of new users, current sales rankings may not matter much. As DNA India notes:

Tier one smartphone brands are ignoring the writing on the wall in the world’s fastest growing smartphone market in order to cater to a global market. This could be a dangerous thing to do especially at a time when the market is growing at a rate of over 150 percent and with 85 percent users still using feature phones. (emphasis added)

2014 could prove a watershed year, considering that:

- 225 million smartphones will be sold in India just in 2014 — compared to 89 million in the US

- Of these 225 million devices, an amazing 207 million will be to first-time smartphone buyers — the largest proportion of new users to existing users anywhere in the world

More so than the spread of 3G/4G, and the rapid improvements in mobile-optimized services, it is the almost unbelievable low prices of new smartphones that are enabling the rapid jump to smartphones in India:

“The median price of a handset has fallen from 8,250 rupees (Dh490) in 2012 to 7,000 in 2013.”

That’s $115.

In fact, about 2/3 of all smartphones sold in India are priced under $200.

The derisively labelled “race to the bottom” is in truth, connecting India, and the world, and gifting us with unbelievably accessible technology.

Mozilla is seeking to create a $25 smartphone. Nokia’s X devices are all priced under $150. The new BlackBerry Z3 costs less than $200. This is amazing and laudable. Indeed, marketing firm Jana, has cleverly predicted that 2014 may be the year when a smartphone costs less than a carton of cigarettes.

The world will never be the same, and what’s happening in India offers us clues to our future.

As the Guardian notes, 2014 is when “the number of mobile internet users in the developing world will overtake those in the developed world.”

Connectivity is flowering in abundance. Equivalent access to everyone and to nearly every data resource will very soon be in the hands of the old and very young, male and female, rich and poor. This may be a first in human history.

We can’t know how this will change us, or change the world. But I suspect that watching what happens in India, and it’s happening so very fast, will provide us with many clues.

Predictions

Sorry. This market is too big, and moving much too fast for me to offer any reliable predictions. That doesn’t prevent me from sharing my thoughts, of course.

Apple

Meh.

Right now, Apple simply has nothing much to offer India. Offering the iPhone 4 for over $200 as they are again, when there are so many other amazing, new smartphones available for far less seems to me almost certain to fail. In fact, I think marketing very old devices against clearly superior ones, at the same price, only harms Apple’s brand. They shouldn’t even bother.

For example, India’s own Lava offers the following Android device for around the same price as the iPhone 4, but here’s what you get:

A sleek, sexy product running on stock Jelly Bean 4.2.1 with a magnesium alloy body, a 4.7-inch HD display, a MediaTek MT6589 chipset, 1GB of RAM, an 8MP camera in the back, a 3MP camera in the front, a panel that includes Sharp’s OGS solution, and Gorilla Glass from Corning.

Or, you can get a Moto G. Even the new Nokia X devices are all available for much less — and they carry the beloved Nokia brand name, look great, and include multiple popular Microsoft services.

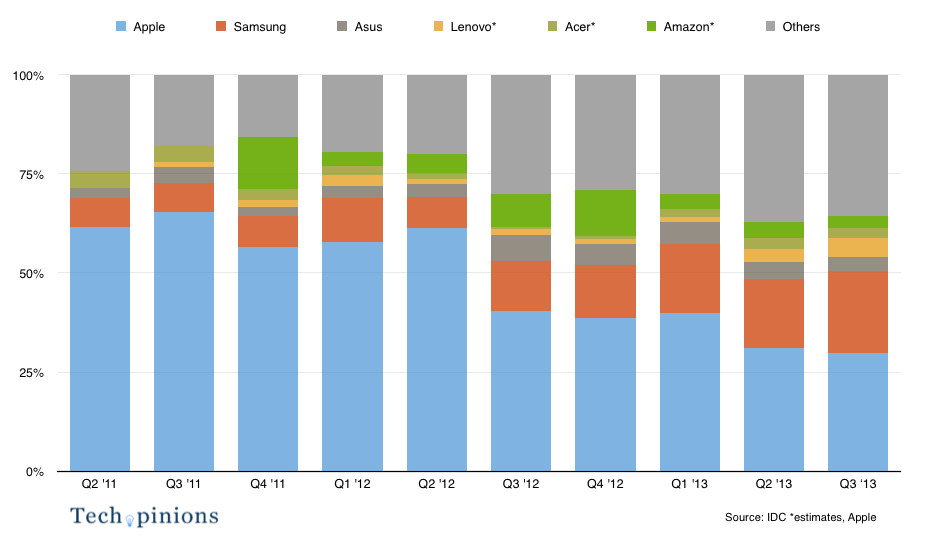

In addition, India loves phablets — which pose a direct threat to iPads. Thus, even sales of iPad are hemmed in. Apple probably won’t have anything to offer India for years, in fact.

Will this harm the bottom line of the world’s largest tech giant?

Not so much, and certainly not in the near term. As long as Apple can peel off the world’s top 10% of buyers, they’ll be fine. It is a shame, however, that Apple and the world’s biggest democracy have so little a connection.

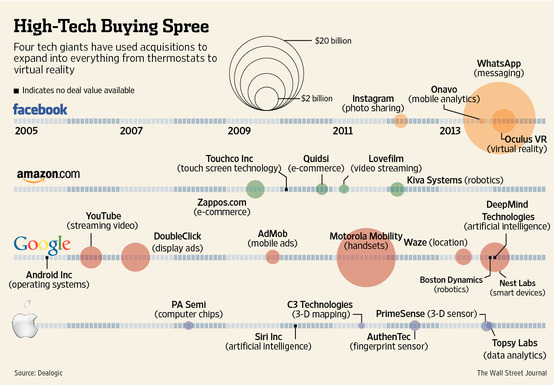

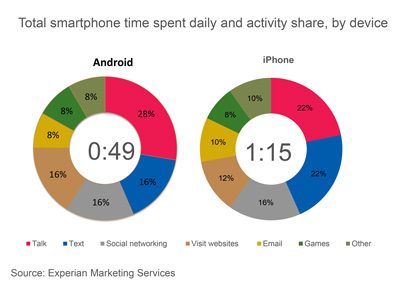

That said, Apple can certainly learn from the India market. For example, Indian handset makers are known for their ability to rapidly iterate, offer a host of new products, new models, all with the latest, most affordable hardware, and all at breakneck speed. Apple offers a minor iPhone upgrade about once a year, and a major upgrade about every 2 years. This has to change for success in the developing world — and it may already be underway. As the Wall Street Journal recently discovered, Apple is “hiring hundreds of new engineers and supply-chain managers in China and Taiwan as it attempts to speed up product development and launch a wider range of devices.”

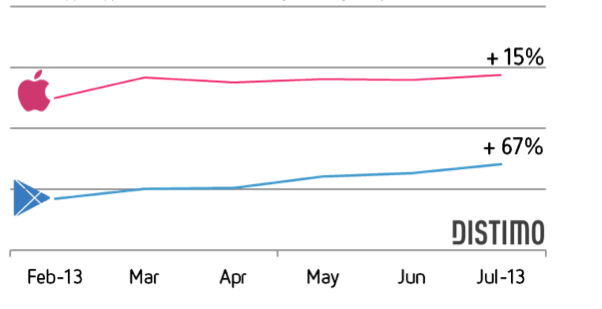

Google

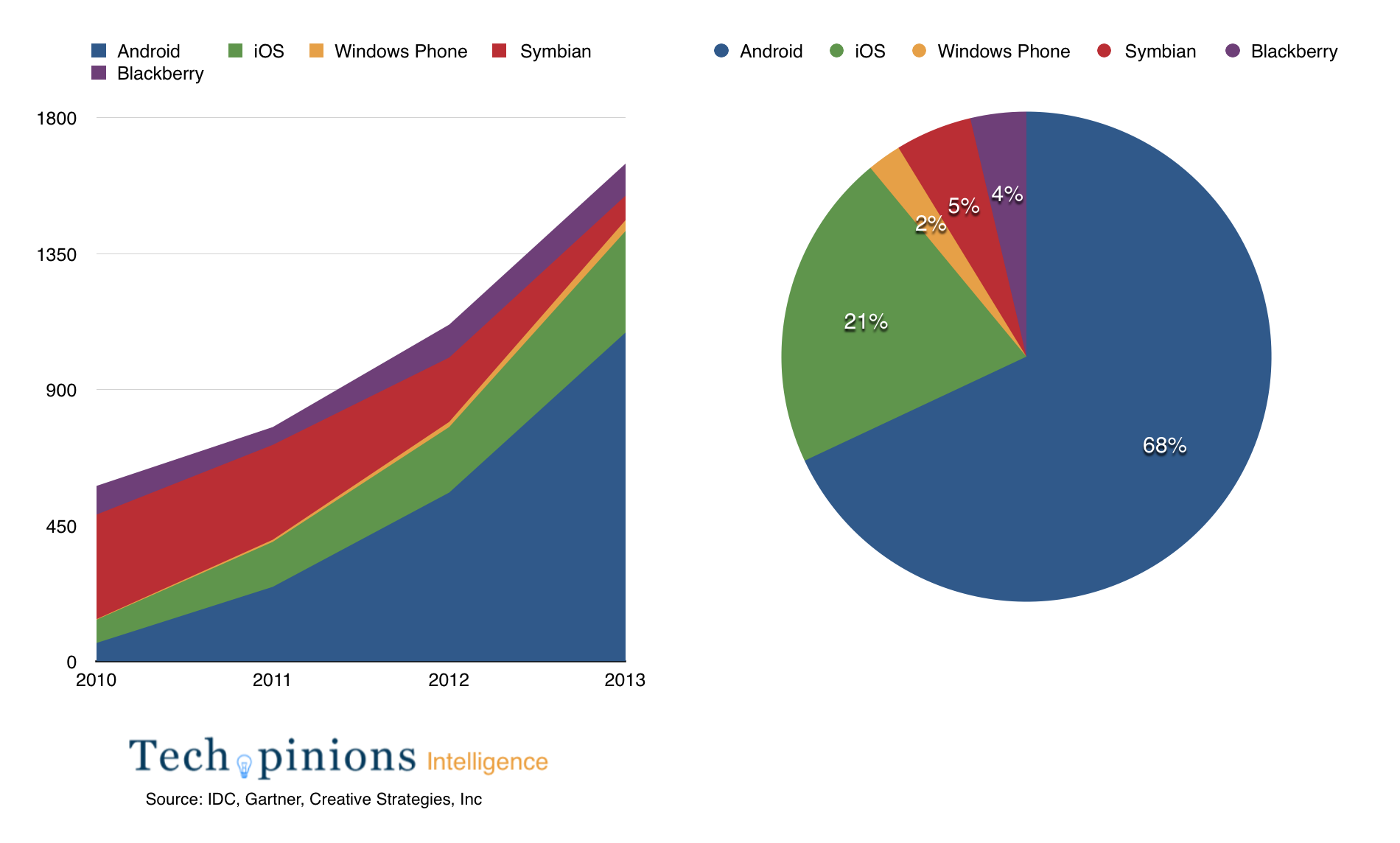

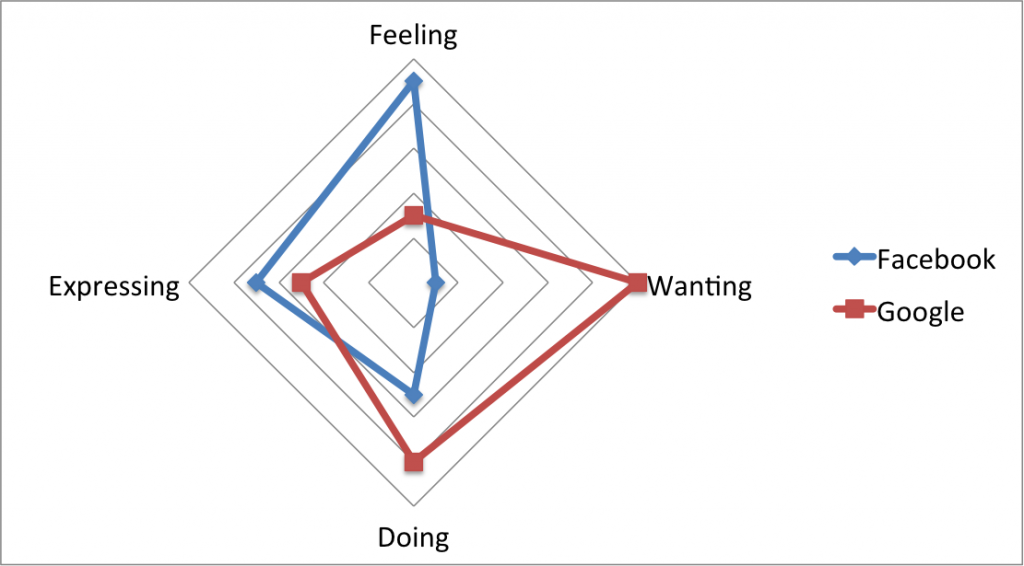

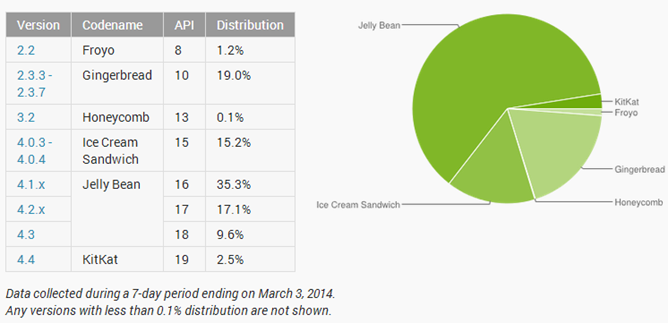

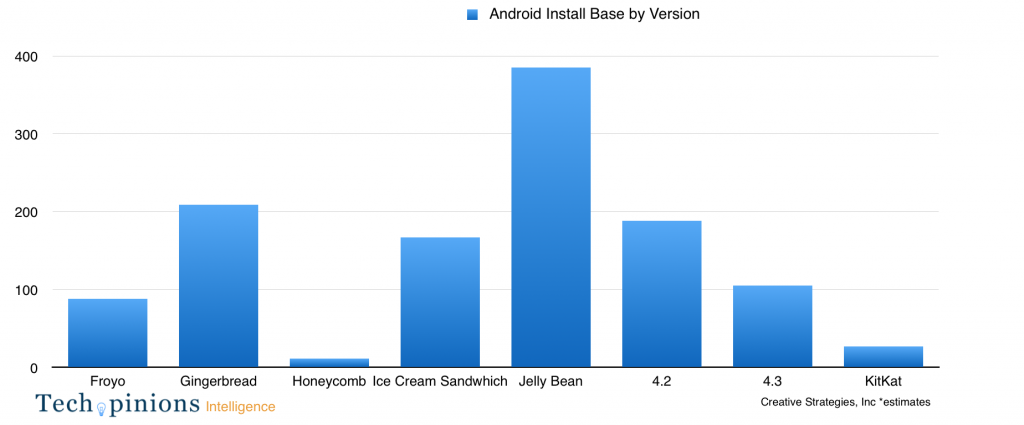

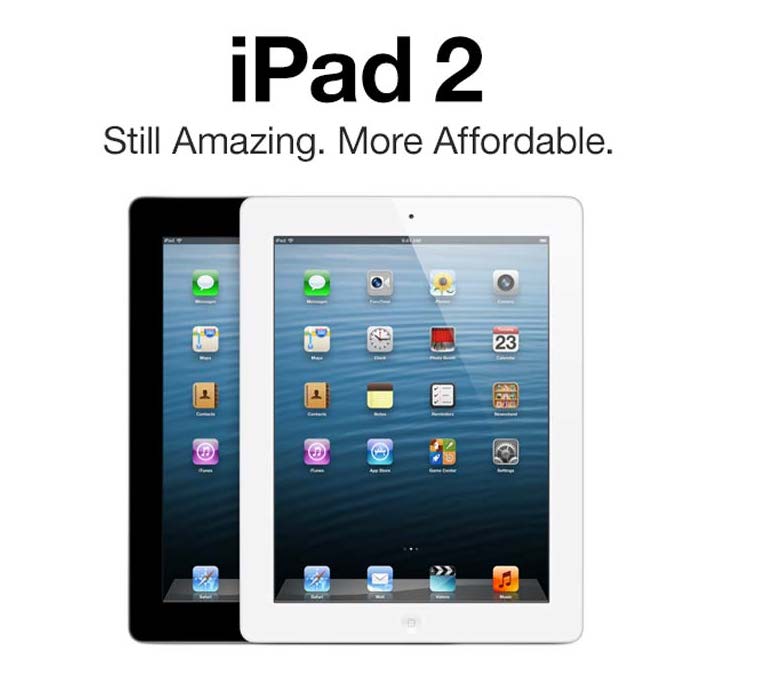

Android is the most popular (smartphone) OS in the world. This is especially true for India, where Google Android may make up 90% of the market. Google should do all it can to continue India’s love of Google Android.

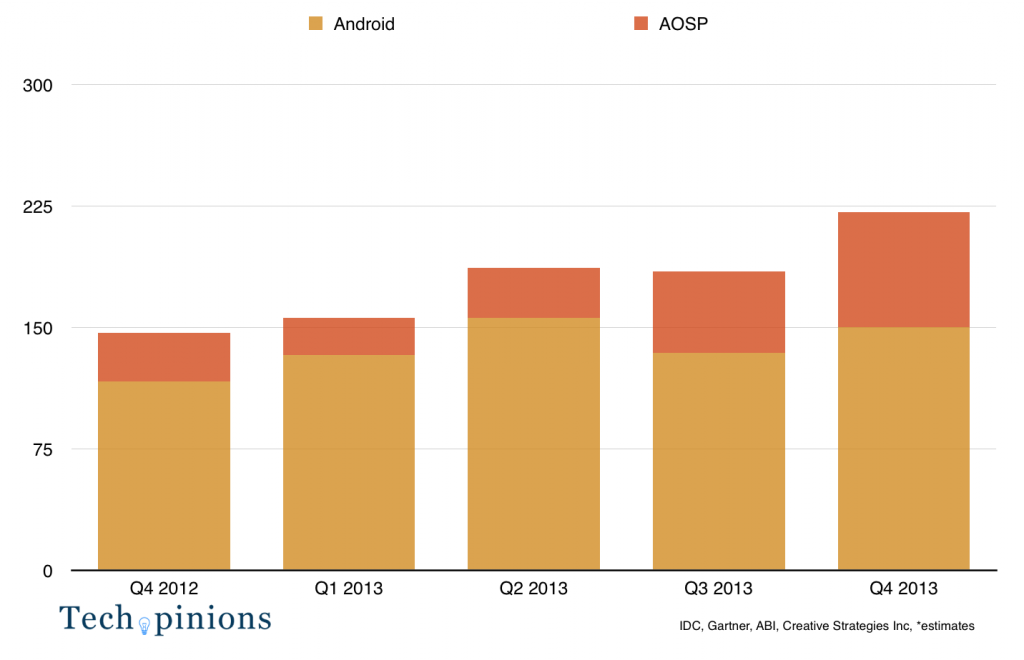

Consider that nearly a third of “Android” smartphones shipped worldwide — that’s now over 70 million devices per quarter — come without Google apps and services installed. Blame, or thank, China, and don’t expect this to change soon. Chinese handset makers, Chinese app stores, Chinese web companies, and the Chinese government itself have little reason to embrace Google or to embed the company’s apps and services into their finished product. If Apple should ignore India for now, as I suggest, Google should similarly ignore China, which will continue to be unfriendly to the company, and instead embrace India.

Google should ensure that its very best tech, its latest services, its most amazingly affordable visions for computing devices all flourish in India, where value and accessibility are paramount. Efforts such as Project Ara, where Google hopes to offer a DIY smartphone for $50, should be heavily promoted and tended to in India, China’s manufacturing prowess notwithstanding.

Nokia

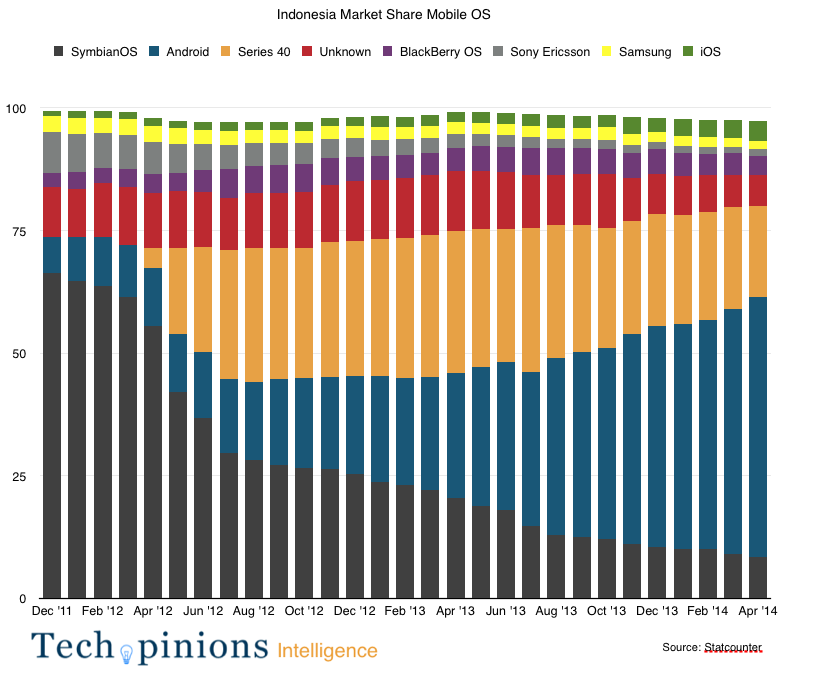

The widely mocked Nokia move to incorporate Android in its new Nokia X line could prove a rather bold, canny move. A feature phone stalwart in India, Nokia has to make an aggressive move to retain relevance in the country’s rapidly shifting phone market. Given the country’s speedy, almost wholesale adoption of Android, this may simply not be possible if Nokia remains fully wedded to Windows Phone.

Nokia’s new X phones will operate on Android, which is everywhere in India. However, they will carry the Nokia brand, retain the familiar Nokia design, keep the look and feel of Windows Phone Metro — and just might renew the company’s smartphone fortunes, all while potentially bringing millions more into the world of Microsoft services.

As Ben Bajarin states:

[Nokia X] is going to help Microsoft acquire customers at the low-end where all the growth is going to come from for the next few years. Every ecosystem needs entry points. Microsoft has a chance to acquire new customers getting their first smartphone and bringing them into the Microsoft ecosystem with a Microsoft ID.

Should the Nokia strategy fail, it’s hard to envision any other OS that is not Android finding any appreciable success in India, no matter the cost.

Where this might be wrong, although I think it unlikely, is if Chinese manufacturers such as the aggressively capable Xiaomi, successfully push out the top Indian mobile phone vendors (e.g. Lava, Karbonn), and thus effectively force them to offer something unique — Windows Phone, even Firefox OS, for example.

Understand, however, that India’s homegrown phone makers are formidable. I do not expect China’s own manufacturers, even such capable ones, to crush India’s leading vendors.

Not all aspects of India’s smartphone market will have a direct parallel elsewhere. The popularity of phablets may never be matched in the US and Europe. Features such as dual SIM are irrelevant in many parts of the world. Nonetheless, the smartphone skirmishes that take place in India will reverberate far beyond its borders. Analysts should pay more attention to this market and its users.