I’ve spent the last week with the Motorola (a Google Company) X. As many who read my columns will know, I prefer iOS to Android and I make that clear. However, when it comes to Android devices I like the stock–Nexus–Android devices the best. Which means, I knew I would like the Motorola X when I first heard about it. However, my desire to experience the device was not because it is running stock Android. It was because I wanted to see if Motorola, the Google company, added any unique differentiators with the software. And they did.

Better Than Stock

What surprised me was that the version of Android on the Motorola X and their new Droid lineup is BETTER than stock Android. It looks and feels exactly like stock Android, but the additions the Motorola software team (I mean members of the ex-Android team) added are very good and feel like features that would come with stock Android on flagship Nexus devices. Yet that is not the case, they are coming on Motorola devices and no one else’s. Not even Nexus devices. At least I am assuming they are not. Time will tell if these great features make it back to the stock Android kernel. But I doubt it.

I kept saying to myself that many of the key new software features felt very Googley. In fact the whole device just felt very Googley. Which is a good thing. Unless you are a competing Android OEM.

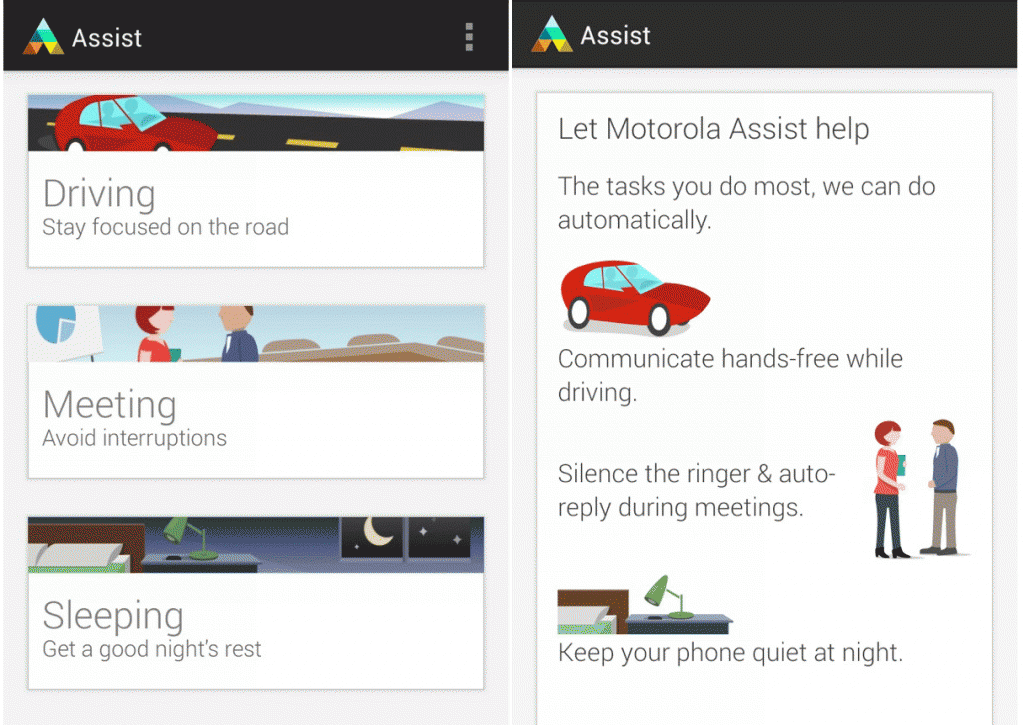

So what features make me say this? There are a few. The first is called Motorola Assist. Motorola has had some of these features at a basic level before. But they have now all gotten much more Googley. Take a look at the screen shot below.

That is the screen for the Motorola Assist feature. It looks very Googley. There are many design similarities to Google Now which is a feature of the latest stock Android build. The features of Motorola assist are also pretty slick.

First, if enabled, when driving it will know you are driving and when a call or text message comes in it will alert you via a voice prompt and allow you to answer a call, deny a call and respond with text message, or offer to read you the text message that arrived. Very nice hands free feature while driving with some good contextual automation built in.

The other that was quite nice and worked much better than I thought was the avoid interruptions during meetings feature. When this feature is enabled the service will be aware of your calendar appointments and auto send text responses to anyone in listed in favorites and let them know you are busy and will get back to them. It also keeps your phone silent of all notifications during this time. My wife LOVED this feature since I tried it by blocking off time when we went to dinner on my calendar and our time remained interruption free. This is similar to the iOS Do Not Disturb feature but is automated based on your calendar appointments.

Information at a Tap

The other addition I liked was Active Display. On the stock Android devices, I am a fan of the lock screen widgets. I use this primarily for email. So I can quickly see if I have important messages that I need to respond to without unlocking the phone. Motorola has added some smarts at the hardware and software layers to add to this feature. The home screen on the Moto X will pulse off an on when you have a notification waiting for you. You can simply tap on the icon and get at a glance any recent emails, text message, or missed calls and then choose to ignore or swipe to unlock the device and respond. This is information at a tap rather than a glance but is very nicely done.

The key to this is that Motorola specifically added some hardware and software features to make use of a low-power processor just dedicated to this feature. This way to look at these notifications on the home screen you can do it without waking the CPU or the whole screen. Since the information is just in black and white the screen and touch features can be used with just the additional low-power core.

The other thing the low-power core can do is look for movement of the device allowing me to just pull it out of my pocket and the screen is already on showing me the time and any notifications without me having to press a button. Very useful feature.

Always Listening and Touch-less Control

The last feature I will dive into is the always listening feature. Also using the low-power core is a feature where the device is always listening for the key word “OK Google Now.” When you say this phrase you can then automate any number of features. You can tell it to call someone, text someone, schedule a meeting, set an alarm, etc. You can do many of the same things you can do with Google Now on many stock Android devices as well as Siri. The difference is that you can initiate the whole process with your voice without having to press a button.

This is the feature that is of extreme interest to me. I’ve always wrestled with the question of what we can do with our devices when they can hear us. Meaning that we can interact with our devices without having to initiate the function physically but rather verbally. We are just scratching the surface in this thinking and when we can train our computers to understand us better and provide fully automated value for functions hands free via voice, I think we will be in some interesting territory.

Measuring Success

From my view as an analyst, I think about how we should measure success for Motorola with this product. We could focus on the hardware which is very good. Motorola has made the most usable 4.7″ screen for one hand operation I have used yet. Or we could focus on the customization trend. Which I think is very interesting and a compelling differentiator for the Moto X. We could also focus on their efforts to make this device locally. I applaud their efforts to build this device in the US and again feel that will have a certain appeal.

For me, however, the way I’ll measure success for Motorola is not in how many devices they sell this quarter or next. Or what market share they gain or don’t gain. For me I will measure success if these devices help establish credibility again for Motorola as a hardware company and specifically a smart phone brand. Brand is everything in my opinion. Motorola had a good one and they are an American success story. I sincerely hope they can re-establish themselves as an innovator, thought leader, and a credible brand. From what I have experienced wit the Moto X, I think they are on the right track.

Other Things I Liked Worth Mentioning

- Battery life was better than average. Motorola touts 24 hours and although I never tested that claim, I routinely used my phone from 6:30am and plugged it in around 10:30pm and the battery level never went below 30%

- Motorola Connect was a nifty feature where by installing a Chrome plug-in you could reply to text messages on the PC as well as choose to ignore a call and respond with a text message all on the PC through the browser plug in. Very clever Google.

and development environments to support this. Why Microsoft? I believe they see that the future of the client is the smartphone and if they don’t win in smartphones, they could lose the future client. They can’t just abandon PCs today, so they are inching toward that with a scalable Metro-Desktop interface and dev environment. Metro for Windows 8 means for Metro apps not just for the PC, but for the tablet and the Windows smartphone. The big question is, if Microsoft sees the decline of the PC platform in favor of the smartphone, then why aren’t all the Windows PC OEMs seeing this too? One thing I am certain of- the PC industry cannot ignore the smartphone market or they won’t be in the client computing market in the long-term.

and development environments to support this. Why Microsoft? I believe they see that the future of the client is the smartphone and if they don’t win in smartphones, they could lose the future client. They can’t just abandon PCs today, so they are inching toward that with a scalable Metro-Desktop interface and dev environment. Metro for Windows 8 means for Metro apps not just for the PC, but for the tablet and the Windows smartphone. The big question is, if Microsoft sees the decline of the PC platform in favor of the smartphone, then why aren’t all the Windows PC OEMs seeing this too? One thing I am certain of- the PC industry cannot ignore the smartphone market or they won’t be in the client computing market in the long-term.