This week was finally Pixel week. Over the past couple of months, we have seen teasers from Made by Google Team as well as leaks and even a Best Buy Canada early release of what the Pixel 4 was meant to be. We also had some details on the Pixel Book Go, the Nest Wi-Fi, and the new Pixel Buds. What was missing, though, was how the Made by Google team was going to frame its story around these products.

I said before that how a company talks and introduces its products are as important as the products themselves when it comes to understanding the vision and the goals of the business. This week’s launch was no different. While some industry watchers criticized the presentation for coming across as choppy, I thought it followed a similar format to the Google i/o main keynote. Product people come on stage to tell their story, talk about their creation, and highlight those aspects they think are a differentiator. I appreciated the attempt to move away from a specs sheet focus and provide more information on the thought process behind the devices and features as well as addressing hot areas such as sustainability and privacy.

Made by Google’s Chief, Rich Osterloh, framed the context around the new devices, but also how the team thinks about the role these devices should play in the users’ life. As he talked about ambient computing and helpful technology, it was impossible not to draw parallels to how Amazon positioned its devices just a few weeks ago.

The devices are not the final product; the technology in them is. From cloud to chipsets to Google Assistant and Soli, the technology that users access is what was on stage in New York.

Helpful Technology and Ambient Computing

Rick Osterloh stressed multiple times how the hardware the team is building focuses on being helpful. The message should sound familiar as the helpful technology tagline was used by Sundar Pichai at Google i/o. If technology is helpful, it will be pervasive in our lives, and privacy will matter more. Of course, if the technology is helpful, we come to rely on it, which creates higher brand loyalty. Helpfulness also drives customer loyalty because the perceived value of the device or service is higher. So far, there has not been any talk about paid services, but I find this emphasis on helpful tech very interesting. I do wonder if framing tech in such a way opens up options for Google to switch some of its services or features to a paid model. This revenue opportunity might also include the prospect of selling their Titan M chip to partners, especially for those who want their products to be Android Enterprise Recommended.

Privacy will also matter when the devices we use disappear and computing powers services and experiences all around us. Google wants the technology to work in such a way that when everything is perfect, the devices disappear. Interestingly this is similar to how Surface’s lead Panos Panay talks about his devices and how they keep you in the flow. It might seem odd that a hardware brand would want its devices to disappear, but if you use any technology, you know you don’t necessarily need to touch or look at a device to get a level of benefit that makes you love it. It is even easier to understand that when the device encapsulates values that are software and services driven and come from the same company.

A Focused Hardware Approach

And so, as much as Pixel 4 might be the iPhone 11 Pro competitor and Pixel Buds 2 might be Made by Google’s take on Air Pods, I cannot help but think that Made by Google’s goals are way more similar to Amazon than Apple. They might play in the same segments as Apple does, and avoiding the comparisons is impossible, but the measure of their success will not be market share but rather the continued adoption of and increased reliance on Google Assistant and the services that are powered by it.

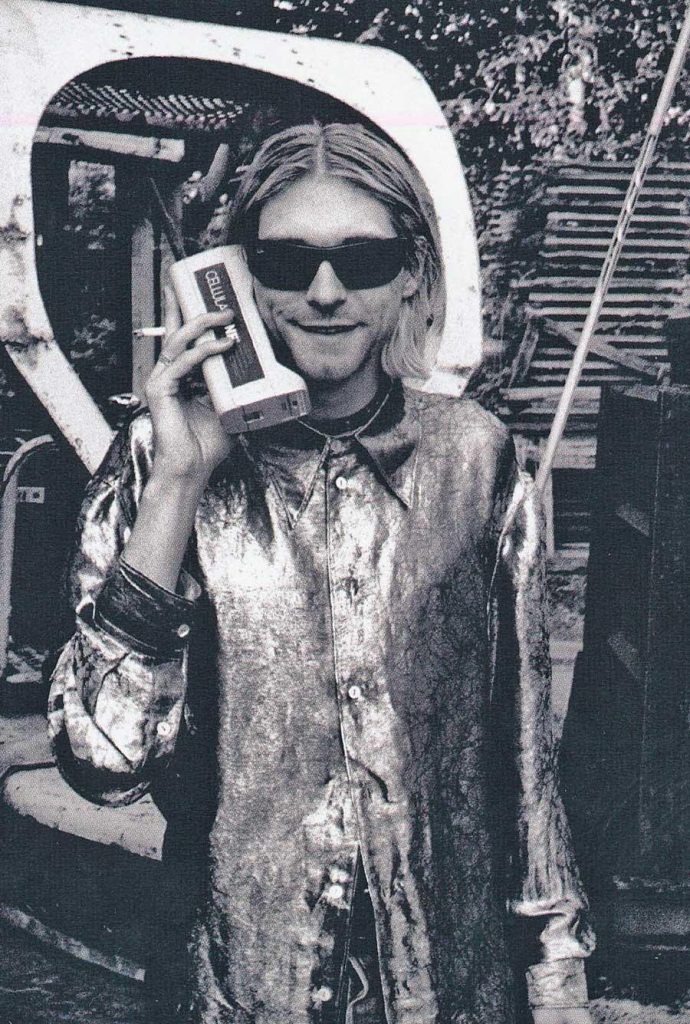

One aspect where Google and Amazon might differ in approach is in the number of devices they decide to bring to market. It is quite apparent, though, why this is the case.

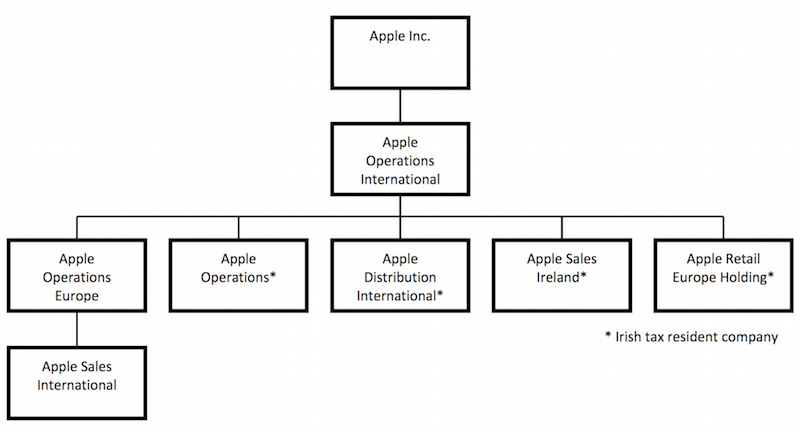

First, investment and leverage. Google has had a somewhat tricky road to hardware. We all remember how much the negative Motorola numbers impacted earnings, so the investment is much more thoughtful now. It is clear Made by Google wants to get to consumers where they get the highest return either on service engagement or cloud. It also means that Made by Google might try and leverage their devices more like they did with the new Nest Wi-Fi and the Google Assistant and smart hub integration. The partner ecosystem can also help Made by Google find those segments where there is value and those where there isn’t. The first smart display product with Google Assistant was brought to market by Lenovo. Following the positive reception of the category, we saw Made by Google launch the Google Home Hub line.

The second factor that makes a difference is, of course, Pixel. The Made by Google phone allows Google Assistant to be with the user all the time. This means, for instance, that no car dedicated device is needed to get to the users while the commute from the office to home. Amazon’s lack of phones means that they need to deliver compelling devices for those situations where users would turn to the phone by default.

No doubt in my mind that being in hardware, software, and services business for Google, Apple, Amazon, and Microsoft makes perfect sense. You just need to stop looking at the hardware as a stand-alone revenue generator and consider the impact it has on driving overall business revenue.

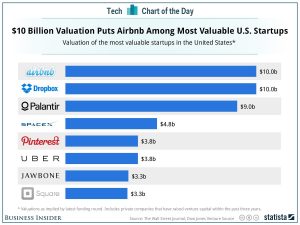

We may never know. Till then, there’s money to be made. Lots of money. And it seems to me that by design or not, and unable to conquer death, Silicon Valley has instead embraced the business model of never growing up.

We may never know. Till then, there’s money to be made. Lots of money. And it seems to me that by design or not, and unable to conquer death, Silicon Valley has instead embraced the business model of never growing up.

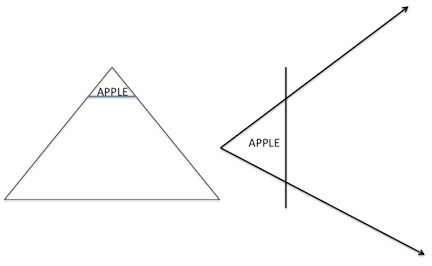

One could describe an elephant as being big, gray and wrinkled. But are those essential or nonessential attributes?

One could describe an elephant as being big, gray and wrinkled. But are those essential or nonessential attributes? What is “essential” to a computing platform is an operating system which forms the foundation upon which third party developers can develop; developers who create desirable products; and consumers who desire and acquire those products. Bigness may be nice, but it ain’t “essential.”

What is “essential” to a computing platform is an operating system which forms the foundation upon which third party developers can develop; developers who create desirable products; and consumers who desire and acquire those products. Bigness may be nice, but it ain’t “essential.”

Pundits get so caught up in technology, that they forget that the technology has to serve a purpose and that the purpose is defined by the user — not the creator — of the technology. The dog at right is standing on a “platform.” It’s an amazing trick. But so what? It’s just a trick, not a sustainable platform. Amazing is not enough. Amazing is a novelty, soon to wear thin. For a product to be successful, it has to be both useful and desirable.

Pundits get so caught up in technology, that they forget that the technology has to serve a purpose and that the purpose is defined by the user — not the creator — of the technology. The dog at right is standing on a “platform.” It’s an amazing trick. But so what? It’s just a trick, not a sustainable platform. Amazing is not enough. Amazing is a novelty, soon to wear thin. For a product to be successful, it has to be both useful and desirable.